Umbrella insurance is a low-cost way to obtain a significant amount of extra liability coverage. Your insurance policy would likely cover the cost of a lost lawsuit, but if it doesn’t, you may lose all your savings. This is where umbrella insurance comes in. For many policyholders, umbrella insurance can provide extra liability coverage at an affordable price. We have compiled this informative guide to umbrella insurance coverage basics to help you determine whether umbrella insurance is the right choice for you.

Jump To:

Umbrella insurance is personal liability insurance that can cover you when you are found liable for a claim that is larger than what your auto insurance or homeowners’ insurance will cover. After an accident, you may deal with the financial consequences if you are held liable. If you are in a situation where someone else is injured or their property is damaged, your existing auto insurance policy or homeowners’ insurance policy may not provide enough coverage for the damage.

Umbrella insurance may also cover certain liability claims that your other policies do not, such as false imprisonment, slander and libel. If you are a rental property owner, an umbrella insurance policy can provide liability coverage that goes beyond the coverage of your renter’s policy. If you are a boat owner, umbrella insurance can provide additional coverage beyond your liability insurance for your watercraft.

Policyholders purchase insurance to protect their assets and family. Many policyholders purchase a personal umbrella insurance policy to obtain coverage that goes beyond other insurance policies. If an accident occurs, umbrella insurance can provide you with the peace of mind you need.

Umbrella insurance covers the policyholder and the policyholder’s family or household members. If you have a teen driver in your family, for example, you can sleep better knowing that your umbrella insurance policy will cover any medical bills for injuries if your teen is responsible for a major car accident. Examine your policy to ensure you understand exactly what and who is covered under your umbrella policy.

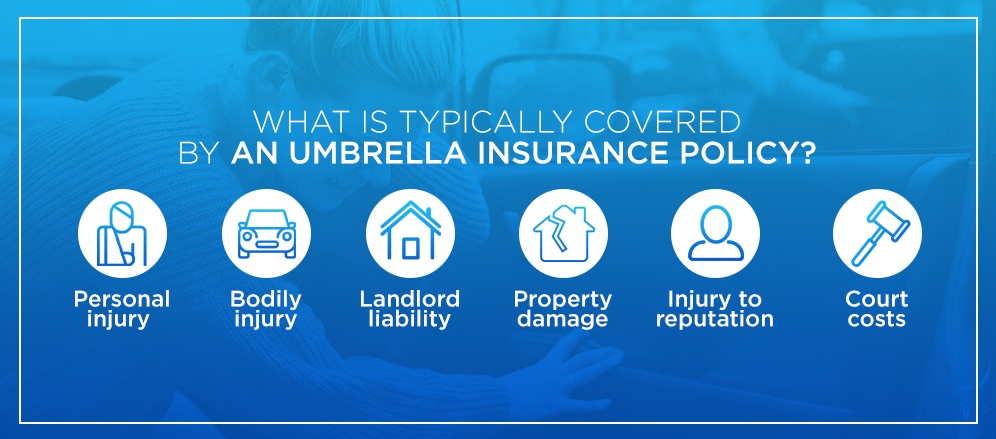

Areas umbrella policies typically cover include:

The following are examples of incidents that may be covered under your umbrella insurance policy if your auto or homeowners insurance does not provide enough coverage:

An incident does not need to involve your vehicle or your property to be covered by your umbrella insurance policy. With an umbrella policy, you will also be covered worldwide, except for homes and vehicles you own under another country’s laws.

Still Unsure? Contact Us to Learn More

One of the best aspects of umbrella insurance policies is that they offer broad coverage. While other insurance policies only cover certain incidents, an umbrella policy will cover any incident that is not specifically excluded. Of course, no insurance policy will cover everything.

The following are some incidents that may be excluded from coverage in an umbrella insurance policy:

Be sure to review your specific policy to determine what is covered and excluded.

Unfortunately, we live in a world where anyone is capable of suing you for virtually anything and ruining you financially. A quick internet search will show you plenty of personal liability stories in which juries awarded millions of dollars to victims that individuals were personally responsible for paying. But how likely are these scenarios? Who needs umbrella insurance to avoid situations like these?

You may have heard the rule of thumb that you should purchase umbrella insurance if the value of your assets and your home equity is greater than the liability limits of your homeowners’ insurance or auto insurance policies. The reasoning behind this idea is that you want enough insurance to cover your assets completely so you will not lose them in the event of a lawsuit.

A jury can easily award a victim an amount that exceeds the limits of your insurance policy. Instead of considering policy limits, you should consider whether you are at risk of being sued. Since nearly everyone is at some risk of being sued, it can make sense to purchase umbrella insurance. For some, buying a policy is a small price to pay for this extra peace of mind.

Some people may need umbrella insurance more than others. You may need umbrella insurance if you engage in activities that increase your risk of incurring excess liability, such as:

If you are likely to be sued, you may want to consider buying umbrella insurance. Additionally, if you are risk-averse, you may want to purchase an umbrella policy to give you the extra protection you desire.

The following are some of the advantages of carrying umbrella insurance:

The following are some of the disadvantages of obtaining umbrella insurance coverage:

As discussed, an umbrella policy provides coverage beyond the liability limits of an existing policy. For example, say you have friends over for cocktails, and one of them falls down your stairs and injures themself. Your guest sues you, and the jury awards the guest a judgment of $1 million. If the limit for personal liability in your homeowners insurance policy is $400,000, you will need to pay the remaining $600,000 out of pocket unless you have an umbrella policy.

To cover this liability amount, you may have to tap into your retirement savings. This could lead to a delay in your retirement timeline by several years unless you can find a higher-paying job or slash your expenses. If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners insurance does not. Additionally, your umbrella policy may cover your attorney fees and other expenses you may incur as a result of the lawsuit. With this type of policy, you won’t have to worry about sacrificing your savings.

In another example, let’s say you lend your car to a friend so they can take a road trip, and they get into a fatal car accident. Though your friend’s auto insurance supplies a payout for the accidental death, their family sues you for damages that amount to $350,000. This part of the situation clearly isn’t covered by your car insurance, so now you must find a way to pay them. Through umbrella insurance, you can ensure you don’t have to pay for many situations your auto coverage doesn’t include.

What can you expect to pay for an umbrella insurance premium? For the amount of coverage you get, the cost can be incredibly low. Umbrella insurance policies usually offer at least an additional $1 million of coverage, and for approximately $150 to $300 per year, you can carry this $1 million of coverage. You can discuss your insurance options with an expert at David Pope Insurance Services, LLC to determine the right amount of coverage and help you find the best rates.

To purchase umbrella insurance, you need to have an existing auto insurance or homeowners’ insurance policy. Umbrella insurance is added to one of your existing policies, which means you cannot purchase it separately.

How much your umbrella insurance costs depends on how much coverage you purchase. You may want to buy enough umbrella insurance to cover your net worth. The more assets you have, the more coverage you will need. Remember that the main reason to get umbrella insurance is to provide coverage for what your existing policies don’t protect. If your auto or home assets are worth more than how much they’re covered, umbrella insurance makes up for that difference.

Fortunately, umbrella insurance remains affordable, even when you have significant assets. As of 2019, auto insurance costs an average of $1,070.47 annually in the United States. Comparatively, home insurance costs an average of $1,854 per year. As you can see, adding umbrella insurance to either of these is not a significant investment. In many cases, supplementing your car or home insurance is a smart and cost-effective decision in the long run.

To purchase umbrella insurance, you need to have an existing auto insurance or homeowners insurance policy. Umbrella insurance is added to one of your existing policies, which means you cannot purchase it separately. Further, you often have to carry the maximum amount of insurance in your state before qualifying for umbrella insurance. If you don’t have this much coverage now, the premium for your umbrella policy may seem more expensive later.

Unlike your other insurance policies, there is no deductible for umbrella insurance. Instead, you will first pay the deductible on your auto insurance or homeowners’ insurance policy. When your home insurance umbrella policy kicks in, you will not need to pay your deductible again.

In addition to personal use, umbrella insurance is also beneficial for commercial uses. Almost every business can benefit from obtaining a commercial umbrella insurance policy, as this policy provides additional liability coverage. With your existing coverage, there is always the chance that you may face a lawsuit that exceeds your liability limits. Umbrella coverage will help you manage risk to your business, so you may want to assess your business’s level of liability risk to determine if this policy is a worthwhile investment.

For instance, if your business employs a fleet of drivers, your organization faces more liability risk than a company that employs workers in an office environment only. Since your business may be held liable for accidents caused by your workers while they are on the road, your liability risk increases when you have employees driving company vehicles. A commercial umbrella policy can help cover this increased risk.

Here are a few other examples of what may be covered under a commercial umbrella insurance plan:

Umbrella coverage sits on top of other policies such as workers’ compensation, commercial general liability, employee benefits liability and commercial auto insurance coverage. Additionally, umbrella protection is often provided over several properties and locations.

An umbrella policy is form following, which means the coverage, conditions and exclusions that apply to your underlying primary commercial insurance policies also apply to your umbrella policy. When comparing commercial versus personal umbrella policies, there is little difference between the two. The main difference between these types of policies lies in the limits, as commercial umbrella policies tend to have much higher limits than personal ones.

A personal umbrella policy provides an extra layer of liability protection on existing coverage, such as homeowners insurance or auto insurance. A commercial umbrella policy provides extra protection over commercial insurance policies, such as general liability or commercial auto insurance. For example, it can provide coverage for claims on hired commercial auto insurance. That means your umbrella insurance will cover any damages caused by vehicles your company is using to deliver its services but doesn’t own.

In short, commercial umbrella policies are for a business’s operations and premises, while personal umbrella insurance is for individuals and families.

Regardless of how much effort your business puts toward prevention and safety, accidents can happen. Prevention alone is not always enough to protect your business completely. To protect your company from incidents beyond your control, you may want to carry a commercial umbrella insurance policy.

Any business that may be at risk of exceeding existing policy limits may want to consider obtaining a commercial umbrella insurance policy — particularly businesses with commercial property open to the public. Working directly with the public can expose your company to a greater amount of liability risk, which means you may want to carry an excess liability insurance policy to protect your assets and avoid damage to your livelihood. Conducting business on another party’s property can also increase your risk, such as with construction or contractor work.

If your business is growing, you may not have enough capital to recover after a lawsuit if you lack coverage. This could mean having to struggle to catch up with expenses or even shut your company down if you cannot meet financial demands. Having a commercial umbrella insurance policy may be the right option to manage risk for your business. Umbrella insurance can keep your company safe if an unexpected incident occurs and disrupts your organization.

The cost of commercial umbrella coverage depends on the policy’s specifics, as with any type of insurance. Another factor that will determine how much you spend on an umbrella insurance policy is the amount of excess liability you obtain.

Many umbrella policies provide policyholders with an additional $1 million of coverage. However, you will pay just a fraction of this additional coverage in premiums. If you choose to obtain more than this $1 million minimum of additional liability coverage, you will pay more for your umbrella coverage.

Your industry may also factor into the cost of your commercial umbrella insurance policy. Industries considered high-risk by insurance companies may be charged more for umbrella insurance, such as the health care industry. The construction, agriculture and mining industries are also known as high-risk due to their high rates of fatalities. For example, research from 2018 showed the agriculture industry has a death rate of 8.44 fatalities per 100,000 workers.

In high-risk sectors, demand for additional coverage is also usually higher than for lower-risk fields, as business owners seek to protect their property and employees from harm and injuries. This need for more insurance can also explain a trend of higher coverage rates.

Your insurance’s cost will be based on your industry, organization size and the scope of your work. For instance, a construction company may pay higher premiums than businesses in many other industries. This is because construction companies work on properties owned by other parties, which significantly increases the risk of liability claims. Additionally, bigger construction companies may pay more for umbrella policies than smaller ones.

With some companies, you may be able to receive a discount after you add an umbrella policy. The discount may even be greater than what the policy costs, which helps you save a significant amount of money. Compared to other types of insurance, umbrella insurance is quite affordable.

Should you purchase commercial umbrella insurance or stand-alone umbrella insurance? Is there personal injury coverage in umbrella insurance? Below we answer a few of the frequently asked questions about umbrella insurance policies we receive from our clients at David Pope Insurance.

Personal liability umbrella insurance can provide additional personal liability protection for a reasonable price. Umbrella insurance can provide you with protection against a personal claim, such as slander, libel or defamation of your character, which may not be covered by another one of your policies.

While umbrella insurance is sometimes called excess liability protection, these are not the same types of insurance. Not every insurance provider offers excess liability coverage. Excess liability insurance policies only provide coverage for the same risks as the underlying policy, and they also have the same exclusions.

If you obtain excess liability coverage on your existing homeowners’ insurance, you will likely have extra protection if you’re found responsible for the injuries a visitor sustains on your property. However, you likely would not have protection for a slander or libel settlement, as defamation is not a risk that is covered by a standard homeowners’ liability insurance policy. ‘

Umbrella insurance may cover liability claims and lawsuits that do not result in legal action. Many people purchase umbrella insurance to protect their assets against potential lawsuits.

When someone brings a lawsuit against you, they are suing to gain reparations for damages they believe you have caused. Liability insurance is designed to protect you in the event that you are found liable for causing bodily injuries or property damage. This insurance is also intended to cover your legal defense, even if you aren’t found liable.

After your deductible is met on your auto or homeowners’ insurance, your liability insurance will cover the costs associated with your claim up to the limits of your policy. When the wronged party is awarded an amount beyond the coverage of your standard liability policy, your umbrella insurance will begin to pay out.

In most circumstances, an umbrella insurance policy will cover property damage. Accidents can happen, and you won’t know the extent of the property damage until you are given an estimate.

If you cause a car accident that involves multiple cars, the property damage to the other vehicles can be extremely costly. This is why an umbrella insurance policy is essential for many policy buyers. If you do not have enough coverage, an accident can result in the loss of your savings. When you purchase umbrella insurance, review your policy to determine in which circumstances property damage is covered.

There are a few different ways you can insure your rental car, such as through your primary auto insurance policy and through the rental agency. You may want to purchase an umbrella liability policy to ensure you are fully financially protected in the event you are responsible for an accident while you are driving your rental car.

To make sure you have adequate coverage in unpredictable situations, including when you have a rental car, you may want to obtain an umbrella insurance policy.

Anyone at risk of a lawsuit or with assets can benefit from the protection provided by liability insurance. If you are a renter with renter’s insurance, an umbrella insurance policy can extend your liability limits.

Your standard renter’s insurance policy may not provide you with adequate coverage, and an umbrella insurance policy can offer you the protection you need. Your umbrella insurance policy can cover any legal fees and help protect your assets if you are held liable for causing bodily injury or property damage.

Umbrella insurance covers accidents that take place during your policy period rather than when a claim is made. If an accident occurs prior to when you buy your umbrella insurance policy, it may not be covered. However, your primary commercial insurance policy may still provide coverage for this accident, including coverage for a lawsuit. Once your policy limit has been reached, additional costs may need to be paid out of pocket.

While you can usually purchase an umbrella insurance policy whenever you want, you may want to obtain coverage before an accident occurs.

While you may have underlying insurance policies with one company, you may not want to purchase umbrella insurance with this company. Perhaps the cost of umbrella insurance at this insurer is higher than at other insurance companies, but you want to keep your underlying policies with them. In this case, you can purchase umbrella insurance separately with a different insurance provider. You may also want to purchase umbrella insurance separately if another company covers more risks.

Before purchasing umbrella insurance separately, ensure you understand what the policy covers. You may also want to carefully consider the benefits that may come from carrying your underlying insurance policies and your umbrella insurance with the same company.

David Pope Insurance Services, LLC is a family-owned, one-stop shop for insurance in Missouri. We know each customer has different insurance needs, which is why we strive to provide flexible coverages for our clients. This dedication has enabled us to become one of Missouri’s most respected insurance brokers.

We can help you find quality insurance policies for your vehicle, home, life and commercial insurance needs with affordable premiums. Tell us about your unique insurance situation, and we will help you figure out the best way to get the coverage you need for the best premium possible.

We can find home insurance coverage for high-value homes and first-time homeowners, as well as life insurance coverage to accommodate policyholders of any age and family size. We can also find auto insurance coverage for motorcycle drivers, older drivers, teen drivers and RV drivers. Let us know what your insurance needs are, and we will work to find the right solution for you.

Are you looking for umbrella insurance in Missouri? Contact us at David Pope Insurance or request a quote today.