With all the financial pressures you may have faced in your 20s, such as paying down your student loans, finding a job that pays decently and saving up for a down payment on your first home, you might not have spent much time thinking about buying a life insurance policy. Life insurance may have seemed like something designed for older, more established people.

In your 30s, you may start to feel more established in your life. You might have bought your first home, gotten married or involved with a long-term partner and you might have a job you love that pays well. Now’s the time to start thinking about buying a life insurance policy. Learn more about the benefits of buying life insurance while you’re young and what size policy is likely to work for you.

One way to figure out at what age you should get life insurance is to ask yourself what would happen if you and your income were no longer around. If you have a child or partner who depends on your income, or if you have certain types of debt, you should seriously consider getting life insurance. While not every 30-year-old needs life insurance, some would greatly benefit from purchasing a policy.

If any of the following apply to you, now is the time to buy a life insurance policy:

Request a Free Life Insurance Quote

Another reason why buying life insurance young makes sense is that the cost of a policy tends to be much more affordable the younger you are when you buy it. Statistically speaking, younger people are less likely to die than older people. The life insurance policy for a 30-year-old is priced with this in mind. Whole and term life insurance rates vary by age. The cost of life insurance at 30 will be much lower than if you wait and buy the same policy at 40 or 50.

Life insurance pays out a death benefit to the person or people named as the beneficiaries on a policy. A life insurance policy pays out the benefits in the event of the death of the policyholder. Life insurance policies cover death for many different causes, including natural death, death by suicide, murder or accidental death. Usually, if crime or fraud is suspected, the policy won’t pay.

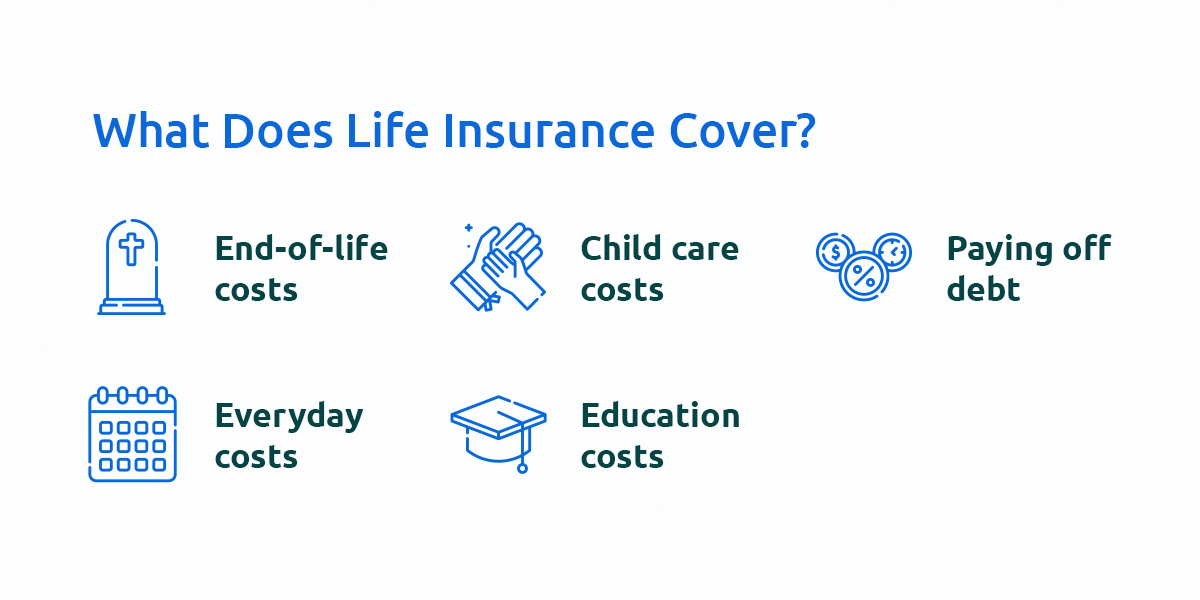

A life insurance policy is likely to spell out how the beneficiaries can use the death benefit. Some allowable expenses include:

Life insurance may cover many types of deaths, including deaths from illness or accidents. Usually, a policy will provide benefits if a person was murdered, but not if the person who murdered the policyholder acted to get access to the life insurance benefits. Some policies exclude certain activities, meaning they won’t pay out if a person engaged in risky behaviors, such as bungee jumping, and died due to the behavior.

Two types of life insurance policies exist, term and whole. When you purchase a term life insurance policy, you’re buying a policy for a defined period, such as 15 or 30 years. You pay the premium on the policy for the set period. Once the policy expires, you no longer pay the premium and your beneficiaries don’t get benefits if you die. Term coverage can be useful if you only expect to need life insurance for a certain period in your life, such as paying off your mortgage or raising your family.

A whole life insurance policy is valid for the rest of your life, as long as you continue to pay the premiums. Whole life insurance plans typically have higher premium costs than term policies, but they never expire. Another advantage of whole life insurance policies is that they also earn interest and act as an investment option. Whole life policies offer cash value, which the policyholder can access while they are alive.

The premium rate you pay for a life insurance policy is based on several factors, including your age and the type of policy you buy. The value of the policy and its duration also influence the premium price. Take a closer look at the factors that determine the cost of a life insurance policy:

Contact Us for More Information

Many factors influence the size of the policy you might need at age 30. Not all 30-year-olds are in the same financial situation or have the same insurance needs. A general rule to follow is to purchase a policy that has benefits that are at least 10 times your annual income. Here’s what to think about when deciding how much life insurance coverage to buy.

The death benefits from a life insurance policy typically serve as a replacement for the income your family will lose after your death. If you earn $50,000 per year and want to follow the general life insurance rule, your insurance policy should provide a benefit of at least $500,000. Generally, this amount should be the bare minimum coverage you get. It accounts for 10 years worth of income, but it doesn’t consider your end-of-life expenses, debts or other financial obligations.

If you have debt, you might want to purchase a larger life insurance policy than someone who is debt-free. Ideally, your policy will pay off your remaining debts after your death and leave your beneficiaries with enough to live on. If you have $250,000 in debt from a mortgage, a credit card and a private student loan your parent co-signed for you, you’ll want to add at least $250,000 to your death benefit.

The number of people you support and their unique needs also influence the amount of life insurance coverage you’ll need to buy. If it’s just you and a partner and you both work outside the home for money, you can buy a smaller policy than someone who has a stay-at-home partner and three kids.

You can use the USDA’s estimated annual cost of raising a child to figure out how much coverage you need. Multiply the annual cost, $12,980, by the number of years your kids have until they are 18. For example, if you have a 5-year-old and a 10-year-old, multiply $12,980 by 12 for the 5-year-old and by 7 for the 10-year-old to figure out how much it will cost to raise them through age 17.

If you hope your kids will pursue post-secondary education, you might want to include the cost of schooling in your death benefit calculations.

While buying life insurance as a young, healthy adult can mean you get the best premium possible, your life insurance policy isn’t a “set it and forget it” thing. It pays to review your insurance coverage annually to make sure it still meets your needs and offers adequate coverage. Try to review your policy at least once a year or when any of the following takes place:

If you get a better-paying job, your household income is likely to increase, which can mean the death benefit’s size should also increase. Getting a promotion or changing jobs can also mean that you have life insurance from your employer, which might affect the amount of coverage you personally need to buy.

Another employment status change that can warrant policy review is if you decide to start your own company or become self-employed. Self-employed people tend to have more financial obligations than people who work for a company. Your insurance agent can help you determine how being self-employed affects your life insurance needs.

You might add to the size of your family, get married, get divorced or start taking care of your aging parents. As the number of dependents you have increases or decreases, the amount of insurance coverage you’ll need will shift, too. Depending on the situation, you might need to add people as beneficiaries or remove them from the policy. If you have more children, you may want to extend the term of your policy to provide coverage for them until they are financially independent.

As your kids get older, they are likely to need insurance coverage from you less and less. Once your kids are financially independent, they don’t need to be beneficiaries of your policy. You might also be able to reduce the size of your policy as your kids get older.

One benefit of buying life insurance when you’re young and in good health is that if your health declines, you won’t have to pay higher premiums, as long as your life insurance policy hasn’t expired. If you take steps to improve your health, you might benefit from a lower premium.

For example, perhaps a person took out the policy at age 30 when they were a smoker. If they quit smoking at age 31, five years later at age 36, their insurance provider might be willing to lower their insurance premiums because they haven’t used tobacco for five years. You might also get a better premium rate if your blood pressure or cholesterol levels improve or if you give up hobbies that the insurance company considered risky.

Your financial situation can change from year to year, based on your debts. For example, if you buy a house, you should review your life insurance policy to ensure the benefit is sufficient to cover the mortgage and other expenses associated with the home. If you buy a car and get a loan to pay for it, you might need to adjust your policy and benefit to include the car loan’s principal amount.

Increases or decreases in your net worth also affect your life insurance policy. If your net worth drops, meaning there would be less to support your family if you were to die, you might consider increasing the size of your life insurance policy.

If you decide to buy whole life insurance, you can take advantage of the policy’s cash value component. A policy with a cash value component has a savings account connected to it. Every time you pay a premium, a portion of the premium goes into the savings account, increasing the policy’s cash value. The cash value might earn a fixed or variable interest rate, depending on the policy. The cash value might also be invested in mutual funds, paying dividends and increasing or decreasing in value based on the market.

The cash value of an insurance policy belongs to the policyholder to use as they wish. You can withdraw the money from the account and use it to pay off a loan or to make a down payment on a home. If you die without using the cash value, any money accrued goes to the insurance company, which uses it to offset your policy’s death benefit.

Using the cash value component of your policy also alters the amount of the death benefit. If your death benefit is $250,000 and your cash value is $10,000, but you use the $10,000 to make a down payment on a home, your death benefit is reduced to $240,000.

One notable benefit of purchasing a cash value life insurance policy is that the cash value is tax-deferred. You don’t have to pay taxes on the account’s earnings or interest until you withdraw it.

If you decide to buy a whole life insurance policy with a cash value component while you’re young, you can benefit in a couple of ways. First, your premiums will be lower than if you were to wait to purchase a policy.

Second, since the policy is for the rest of your life, your cash value will have a considerable amount of time to grow. Money invested in the account at age 30 is going to have 10 more years to grow than money invested at age 40.

Some people are likely to enjoy the benefits of investing in life insurance more than others. There might be other, tax-advantaged investment options available to you, such as a 401(k) or an IRA, which can provide better growth potential. Usually, the people who are likely to benefit the most from investing in life insurance have high incomes and have already made the maximum contributions allowed to other retirement accounts. A cash value insurance policy provides high-earners with an additional, tax-deferred investment option.

If anyone else depends on your income or if you have debt, you need life insurance, whether you’re in your 30s or older. The specific details of your policy depend on your needs today and your anticipated needs in the future. David Pope Insurance can help you choose the right life insurance policy in Missouri. Whether you’re looking for term life insurance or whole life insurance or have questions about a policy with a cash value component, we can explain the differences to you and how each option affects your premiums or the coverage your beneficiaries receive.

To learn more, contact our office today. You can also request a free quote online.