Are you looking to begin a career as an insurance agent in Missouri? The various insurance types and available agent roles ensure you can find the right path for your interests and work ethic.

As an insurance agent, also called an insurance producer or insurance broker, you’ll help people or companies get the financial compensation they need during life’s big moments. People buy customized insurance plans to fit their needs so they can enjoy their houses, cars and businesses risk-free. Selling insurance can be a rewarding way to connect with others while expanding your professional knowledge.

If you are wondering what it takes to become an insurance agent, this guide will help you learn everything you need to know about practicing insurance in Missouri, from the license application process to the different lines of insurance you can work with.

Jump To:

When starting in the insurance field, you’ll want to understand the two primary categories of insurance agents. Each position helps you play a different role in people’s lives, and your choice will depend on the environment you want to work in daily. Before deciding which type of insurance agent you want to become, you should understand the various insurance products and policies in the market. Here are a few common kinds of insurance.

When starting in the insurance field, you’ll want to understand the two major categories of insurance agents. Each position helps you play a different role in people’s lives, and your choice will depend on the type of environment you want to work in daily.

Insurance brokers help people and businesses navigate the complexities of insurance, acting as the bridge between insurance providers and insurance seekers. They receive a commission from the insurance provider and do not typically get compensation from the client.

They conduct assessments to evaluate the client’s needs and risk level. With their in-depth market knowledge, they research various insurance companies and available options, measuring this against the client assessment. Then, they present the client with a few tailored recommendations that offer pros, cons and objective advice. Insurance brokers can negotiate with insurance providers to secure the best terms for their clients before placing the policy with the company on their clients’ behalf.

These insurance agents work for only one insurance company. The business they work for limits their scope, as captive agents can only sell their employer’s products and work with their company’s clients.

If you’re interested in a single company’s culture and want to dedicate yourself to learning all the details about one insurance business’ products and policies, becoming a captive producer may be the right path for you. Captive agents gain a profound understanding of their company, resulting in outstanding customer service. Typically, these producers receive a yearly salary, and many also earn commission and company benefits.

Independent insurance agents represent many businesses, selling products and policies to several companies’ clients. Independent insurance producers aren’t employees of any enterprise, so instead of earning a yearly salary, insurance groups pay them a commission for the policies they sell.

If you’re interested in helping clients find the best available insurance policy, becoming an independent agent would allow you to do that because you can match your client’s specific coverage needs with multiple policy options at different prices. Because they’re unaffiliated with any company, independent agents also usually conduct self-sufficient business operations, such as creating advertising materials and marketing themselves to insurance companies.

To be eligible to become an insurance agent in Missouri, you must be at least 18 years old with a high school diploma or equivalent degree. Since this position involves sales techniques, some employers may prefer graduates with bachelor’s degrees in relevant fields such as business, communications or psychology.

It is beneficial to have excellent communication skills, high emotional intelligence, persistence, technical know-how and strong analytical and problem-solving abilities.

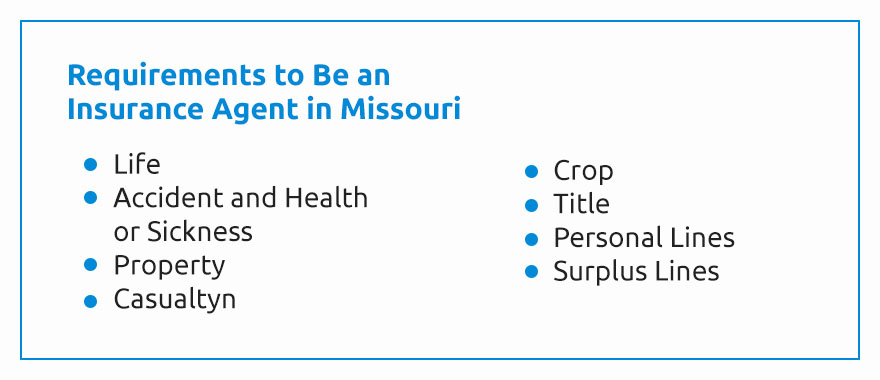

Missouri insurance license requirements also include passing the state licensing examination and submitting the application and the $100 application fee. Passing state licensing exams allows you to practice in the areas of life, accident and health or sickness, property, casualty, crop, title insurance, personal lines and surplus lines.

You can get licensed without taking an examination to practice credit or travel insurance. If you’re a veteran, you can get reimbursed for the cost of your first exam and many subsequent exams through the GI Bill. You can still get your insurance agent license if you have a criminal record. On your application, you’ll need to provide information about your conviction in the form of certified documents.

To become an expert in your field, you can consider getting a chartered property casualty underwriter designation, a certified risk manager, a certified workers’ compensation specialist, a certified risk manager or an accredited advisor in insurance.

You’ll need a specific state license for each type of insurance you want to practice.

Many agents choose to specialize in one line of insurance. However, having licensure in as many lines as possible is also a great way to stand out to insurance companies and ensure you have the expertise to help various clients. Here are the primary insurance lines and their licensing information.

To become an expert in your field, you can consider getting a chartered property casualty underwriter designation, a certified risk manager, a certified workers’ compensation specialist, a certified risk manager or an accredited advisor in insurance.

You’ll need a specific state license for each type of insurance you want to practice.

Many agents choose to specialize in one line of insurance. However, having licensure in as many lines as possible is also a great way to stand out to insurance companies and ensure you have the expertise to help various clients. Here are the primary insurance lines and their licensing information.

Property and casualty insurance financially protects people and businesses after damages associated with their buildings, land, belongings and cars. The umbrella terms “property” and “casualty” include many specific types of insurance, including vehicle, liability and theft insurance, as well as workers’ compensation, renters insurance and homeowners insurance.

Property insurance protects the insured’s belongings in situations such as theft, fire, crashes and natural disasters, while casualty insurance protects the insured if they become legally liable for another person’s injuries or damages. Becoming licensed in this line of insurance allows you to sell property and casualty insurance policies to help people afford to pay for any issues that may arise with their property or belongings.

Property and casualty insurance comes in two forms.

Life insurance is a policy paid in a lump sum to a person’s beneficiaries after their death. As a specific type of personal line casualty insurance, life insurance helps people financially after the death of a family member.

Having a Missouri life insurance license equips you to help people avoid money problems during some of the most challenging times of their lives. Many agents who sell life insurance policies also sell annuities so people can receive a retirement income and be financially stable throughout their golden years.

Health insurance covers a percentage of people’s health care costs and can help people afford the costs of medications, doctor visits, hospital stays and more. A license to sell this specific insurance lets you help people take care of their health with as much financial assistance as possible.

Some license tests combine multiple types of licenses. For example, you can take a test to get a life and health insurance license or a test that combines the license procedures for property and casualty insurance.

Passing the insurance exam is your first step toward becoming an insurance agent, and taking your preparation time seriously will help you achieve a good score. Each exam has a list of content outlines you can follow to ensure you’re studying the most relevant topics. These lists also include legal information specific to Missouri that’s critical to know for all lines and license types.

Pearson VUE, Missouri’s certification exam supplier, also offers many test-taking resources to help you prepare for your exam. Practice tests can help you review the information and learn the test styles for life, health, property and casualty insurance.

If you plan to take the exam at a testing location, prepare the documents you must bring. If you’re taking the exam remotely, ensure you have a quiet, distraction-free place to work for the entire test. Remember, most insurance exams are one to three hours long, with no breaks.

Once you’ve decided to take the Missouri insurance licensing exam, make a reservation with Pearson VUE online or schedule one over the phone at 866-274-4740. You can take your exam at an official Pearson VUE testing location or online from the comfort of your home or office. Either way, you should make a reservation at least 24 hours before your desired test day.

When scheduling your exam, have your Social Security number, the name of the exam you want to take and your preferred exam dates and test center locations information on hand.

When you register, be ready to pay the exam fee. If you need to change or cancel your reservation, call Pearson VUE at 866-274-4740 at least 48 hours before your exam time to receive a full refund for your exam fee.

If you would benefit from ADA accommodations for a documented disability, provide Pearson VUE with the appropriate documentation. You may also request additional time as an English as a Second Language student by submitting a request form and proper documentation.

If you’re taking your test in person, arrive 30 minutes before your exam time to complete your registration. Bring two acceptable forms of identification and any other materials your registration requires.

When you finish your exam, you’ll receive a report with either a passing or failing score. Apply for your license after you pass. If you would like to retake the exam, you must wait one day after receiving your score before registering again.

Exam scores are valid for one year after you take the exam. Within the year after you pass the exam, you can apply for your license by applying to the Missouri Department of Insurance through the National Insurance Producer Registry, a licensing resource that compiles data from across all state licensing databases.

Once you’ve passed your exam and successfully applied to the department, they’ll give you your Missouri insurance agent license if they accept your application. From there, your next step is to apply to work with or for insurance companies as an independent or captive producer to start legally selling policies.

Even when you have your insurance producer license, you can’t legally solicit or sell any insurance policies until you begin working with a company. Within 30 days of an insurance company authorizing you to sell insurance for them, they’ll put your name and information on their list of company-appointed producers, and you can begin working with clients and selling insurance.

Gaining some experience to help you hone those communication and negotiation skills is a good idea. Insurance selling is a profession where every interaction you have can become an opportunity to gain better insight. Practical experience in the form of an internship or entry-level role allows you to start networking with clients and learning how to handle insurance documents hands-on. Work experience lets you observe seasoned professionals and learn techniques and strategies for your new profession.

Once you have your license, you must keep up with future renewal deadlines. Here are some common questions surrounding the license upkeep process.

Missouri insurance producer licenses expire every two years. About 60 to 90 days before your license expires, you’ll receive a notice from the Missouri Department of Insurance telling you your renewal is due on or before your current licence’s expiration date.

To avoid late fees and unintentional termination of your license, return all renewal documents by your license’s expiration date. You’ll owe a late fee of $25 per month for every month after your license expires until you submit your renewal. If a year passes after your license expires and you still haven’t renewed it, you must apply for a new one.

Electronic renewal makes renewing your license on time easier than ever. First, update your address if it has changed since you received your current license. Then, make sure your continuing education is up to date. Finally, submit your renewal documents and the $100 renewal fee.

Once you have your insurance producer license, you’ll want to keep your skills and knowledge sharp. Changes in laws, benefits programs and other government regulations can all affect clients’ insurance needs. Refreshing your memory and staying updated on changing information in your licensed field will help you best serve your clients and the insurance company you work with.

Continuing education is also necessary for license renewal. During every two years of licensed practice, insurance agents must complete courses approved by the Missouri Insurance Department and submit documentation of their learning with their license renewal request. Only producers who have successfully completed the continuing education requirements for their specific practice areas will be able to renew their licenses.

Specific continuing education requirements include:

For life, health, property and casualty licenses, course requirements include at least three hours of insurance ethics instruction.

Are you moving to Missouri from another state? Each state has a somewhat different process for testing potential insurance agents’ knowledge, giving licenses and appointing producers. The good news is, if you currently hold or have held an agent, broker or producer license in another state within the past 90 days of relocating to Missouri, you won’t need to take another exam for most of the lines you already have a license for. The only exception to the above exemption is that if you’re a title agent, you will need to retake the title exam for the state of Missouri.

Another career option in the insurance field is an insurance adjuster. Adjusters work alongside insurance companies, investigating insurance claims to determine whether an insurance company should pay for a client’s losses and, if so, how much of those losses they should cover. Insurance companies can hire in-house adjusters or independent contractors to do this job.

Insurance adjustment might be your career path if you enjoy sorting through information and solving problems. Adjusters decide fair settlements by looking at medical bills, injuries, property damage and official reports and using fair evaluation skills to assess the costs of damages. Adjusters also speak with claimants and correspond with witnesses to get the full picture before deciding how much of a loss an insurance company should cover.

From there, adjusters write claims reports and negotiate and settle clients’ claims. They also help their clients understand the claims and the amount of money they may be responsible for.

Many clients find insurance claims to be complicated and overwhelming. As an insurance adjuster, you take this burden off your clients and expertly review their cases to provide them with the best coverage possible for their situations.

The two primary types of insurance adjusters are public and independent. They have different priorities depending on their ties to clients and insurance companies.

To become an adjuster, you must fulfill slightly different requirements from those necessary for insurance agents. Missouri is unique from most other states because it doesn’t require licenses for insurance adjusters. Follow these steps to become an insurance adjuster in Missouri.

If you choose, you can take a public adjuster exam and become a licensed public adjuster in Missouri to further show your expertise in the field.

As a highly qualified insurance agent, you’ll provide clients with the expertise they need to get financial coverage for injuries, property loss and more. Working closely with clients on their cases, you’ll assess people’s risk levels and give them the best insurance plans your company offers.

David Pope Insurance Services, LLC, commits to providing Missourians with personalized, comprehensive coverage plans for all their short- and long-term needs. We want motivated people to join our team.

We invite you to learn more about becoming a successful insurance agent with David Pope. Contact us today to see how you can work with us!