Owning a home is a great investment and offers a sense of security for you and your family. Financial goals for homeowners are what help keep your home a worthwhile investment. It all begins with budgeting, and purchasing your first home is a great time to hone your budgeting skills to make your money work for you.

Generally, the 50-20-30 rule is popular, with 50% of your net income going to necessities, 20% going to debt repayment and 30% going to your wants. However, depending on your goals, you may want to put a higher percentage toward debt repayment and less towards wants, making it a 50-30-20 rule instead.

For homeowners, there are additional costs to consider, such as a mortgage, home maintenance, emergencies and savings for the future or for kids. Having specific financial goals to accommodate these new considerations is one of the best ways to stay afloat with juggling old and new financial responsibilities.

To simplify it, we’ve put together the four main financial goals for first-time homeowners:

Budgeting for homeownership and creating financial goals as first-time homeowners aren’t that different. Both require surveying your finances, growing savings and reducing debt to obtain a mortgage. The difference is that a budget for a first-time homebuyer needs to accommodate specific household expenses, like those for home emergencies, while paying down the mortgage.

To do that, you first need to have a thorough understanding of how much money is coming in and where it needs to be distributed within your household.

The very basics of budgeting include calculating your household income, subtracting your fixed expenses from it and deciding how to best allocate the remaining funds. Fixed amounts include things like:

Some homeowners may not have all those fixed fees — for example, not every home requires condo fees, and some people may not opt for home security. But every homeowner will have new regular expenses, which will likely differ from those you had before being a homeowner. You may find yourself unable to direct as much toward credit cards or other loans, but those still need to be factored in.

As a homeowner, you will likely be responsible for any home repairs that come up as well as any home emergencies, like dealing with plumbing issues or renovations. Those all need to be factored into an emergency fund, which we’ll discuss more later on.

Other monthly expenses can fluctuate, which can make it difficult to set aside enough to cover them. These include:

It’s a good idea to look over how much you spent on these items in the last few months and use the month with the highest amount as the base. Alternatively, you can calculate the monthly average and use that as your baseline. Another option is to create a fixed amount dedicated to these expenses and ensure everyone in the household works together to stay within the budget. That could mean ensuring people switch off lights in unoccupied rooms to conserve electricity, fixing dripping faucets quickly to reduce wasted water or taking on landscaping and housekeeping chores yourself instead of hiring someone to do it.

Documenting these expenses is crucial because you can’t remember them all yourself and the household budget should be something shared between you and your significant other. Creating a spreadsheet you and your partner can access is a good option since it neatly lays out all the finances as they come in and go out. Some people prefer to use pencil and paper to keep track of expenses, and that’s just as valid an option.

The bottom line is to make sure there is a clear and detailed record of the household finances so you can see how much of your expenses are going towards the necessities. Once you have a good idea of your necessary expenses, you can determine how much is left over for the non-essential spending. This can include money put towards retirement savings, college funds or savings for a vacation.

When you take out a mortgage, there are actually two payments for which you’ll be responsible: the principal and the interest.

The principal amount is the total amount of your mortgage. For example, if you have saved $40,000 and the home you’re buying costs $200,000, you will need a mortgage of $160,000 to cover the cost. That $160,000 is the principal amount, and you will be charged interest on it.

The interest is essentially the amount you’re paying the lender to borrow the principal. The interest amount can vary based on the length of your mortgage and the interest rate. Oftentimes, the interest rate is fixed, allowing you to make set payments every month — a fraction of which goes towards the principal while the rest is interest. Your monthly mortgage payments may also include other things, like homeowners’ insurance or property taxes.

There are several ways you can pay off the principal faster — something that’s often a goal for people who want to be free of mortgage debt and save money by paying less interest. There are likely rules regarding how quickly you can pay off your mortgage, which should be outlined in your mortgage contract. It’s important to make sure you’re fully aware of the stipulations around your mortgage or else you could face unwanted penalties.

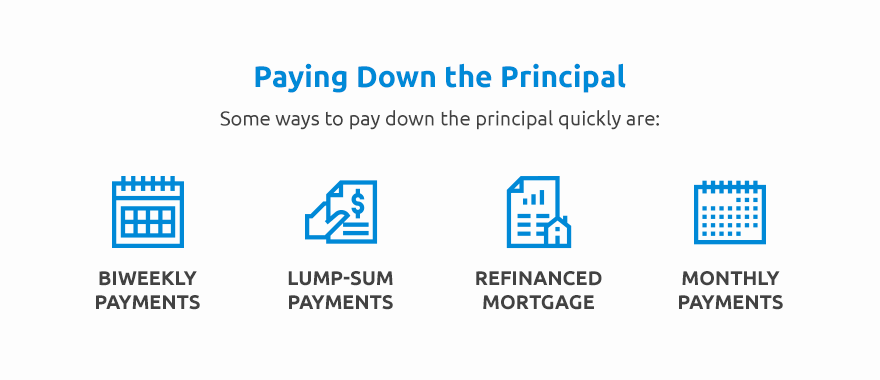

Some ways to pay down the principal quickly are:

While paying off the mortgage early is a great goal, you should examine your budget and lifestyle before determining if it is the best route for you. If you’re self-employed or work from home, you may be able to claim a portion of your mortgage interest on your taxes. Claiming this reduces your taxable income, making paying off the mortgage too quickly an unnecessary pressure. Similarly, if you have two mortgages — one on your personal home and another in an investment home — it makes more sense to focus on paying off the mortgage for your primary residence before working on the investment home.

While your mortgage should be a priority, it doesn’t mean you can push all other loans and debts to the side. Credit card balances, car loans and other debt should be tackled before you shift your focus to paying off your principal.

You’ve probably heard of “good” and “bad” debt, with student loans and your mortgages being good debt while credit card debts are bad. A good practice is to get rid of all the bad debt first before working to get rid of the good debt. Good debt, like your mortgage, tends to have lower interest rates than bad debt, so if you find yourself with some extra money, instead of making a lump-sum payment toward your mortgage, put it toward credit cards, payday loans or high-interest personal loans first.

Once those bad debts have been cleared, you can start to focus on building up savings — for retirement, emergency funds or your children’s college funds — and prioritize paying off your mortgage faster once your savings are secure.

Savings are sometimes seen as unobtainable, especially when you’ve invested so much into buying a home. But savings are crucial for maintaining a stable household budget, especially since most home repair costs will fall on you as the homeowner. These can include minor fixes, like changing locks, to major fixes, like replacing the roof. Whatever the repair, it’s important to make sure there is enough money saved up to take care of it — especially since prolonging a repair could lead to bigger, more costly issues down the road.

Something to include in a financial checklist for new homeowners is allocating money for various savings accounts. Your personal savings — which include retirement savings, college funds and general savings for emergencies — are extremely important, but you should also have an emergency fund for household emergencies that is separate from your personal savings.

A good practice is to open one account for personal savings and another for household savings. Factor in contributions to these savings accounts in your household budget. Setting up automatic payments is a great way to ensure an adequate amount of your income goes towards savings without having to worry about remembering to move the money. Automated payments are also great because they can prevent you from spending that money unnecessarily.

Your home savings account can be used to take care of any sudden issues that may arise — like the need to hire an electrician, replace a kitchen appliance or pay for major repairs after a natural disaster. It can also be used for any planned maintenance, like if you plan to renovate the basement or want to build an addition to your home. The amount you’ll need to put aside will depend on the age of your home — older homes will likely need more repairs over time than newer ones because the appliances in older homes will likely be closer to the end of their life span than those in newer homes.

As your home ages, there’s a good chance it will need bigger and more repairs. Ensuring regular maintenance lessens this chance, but you never know what could happen. Homeowner’s emergency funds can help you prepare for the unexpected.

The economy isn’t static and will fluctuate over time. This means the budget you set five years ago may not be as effective today and needs to be updated.

Regularly reviewing your budget is a good habit, and the reviews are best done every month or so. This allows you and your significant other to see where your money is going and quickly tell if you’re overspending before it becomes a bigger issue. A regular review also helps you see whether the goals you set for yourself are working out or if they need to be adjusted according to your reality.

If your sources of income dry up, it’s obviously a cause for reviewing your budget and readjusting your wants and needs. However, if you come into a sum of money, it also makes sense to do a budget review to see where that money can work the best. Surprise income could be anything from an inheritance to a pay raise or big tax return.

Since you’re responsible for covering any emergency repairs for your new home, you’ll need to ensure you’re prepared for them without taxing your budget — especially if it’s already stretched thin.

Putting aside as little as $100 a month can quickly add up to hefty savings, which can give you peace of mind for potential emergencies. While there’s no right way to save for home maintenance, there are a couple of methods people use to calculate the amount:

It’s a good idea to keep your home repair savings in a separate bank account — one that’s liquid, so you can access the money as soon as you need it, but that isn’t as easily accessible so you’re not tempted to spend the money you’ve been saving. Using a high-interest savings account for home emergency funds is a good idea since it can help your principal savings grow quickly. It may also be wise to automate your payments into that account to ensure it is always fed.

The type of home insurance you choose will depend on several factors, including:

You should also be aware of what the insurance policy requires from you as the homeowner. Renovations, prolonged absences or beginning a business from your primary residence could all influence your insurance coverage. Even seemingly harmless things like home-sharing aren’t covered by most home insurances and require separate insurance. Be sure that your coverage truly addresses your unique needs.

Purchasing a home is a great accomplishment, and the right home insurance helps keep it a valuable investment. At David Pope Insurance, we understand the importance of protecting your new home, which is why we work to find the very best price for you. We’re determined to keep your costs low while providing the peace of mind that comes with knowing your biggest purchase is secured.

Whether it’s landlord insurance, condominium insurance or renter’s insurance, let David Pope Insurance help you find the best policy for you. Request a free quote by calling 636-535-1055 today.