Car insurance can be challenging to understand, especially after an accident. If you’ve been in an accident, you should know how it will affect your insurance rates and what to expect in the years to follow. Learn more about an accident’s impact on your insurance rates, how long the effects last and how you may save some money.

Your rates will typically increase when you’re at fault in a car accident, since you’ll be a higher risk to insure moving forward. The amount your premium could increase depends on numerous factors, like the state you live in, previous claims and your driving record. Some states even consider your age — younger drivers are a riskier demographic to insure, especially after an accident.

In the United States, annual insurance premiums increase an average of $750 after an at-fault accident. Since this number is an average, some states may increase your premium by more than $750. You’ll also see a more considerable increase depending on how much damage you caused in the accident. Good driver and claims-free discounts reduce your premium for having good driving habits. However, an accident will likely knock out these discounts and make the premium increase seem even more significant.

To give you an idea of how much premium increases can vary after an accident with full coverage and what to expect in your state, here’s a list of average insurance premium increases in each state.

The rate at which your insurance premium increases after an accident also depends on your insurance provider. While you’ll likely see a rate hike after an at-fault accident, that varies depending on your provider. For example, Nationwide averages a $419 increase, Allstate averages a $719 increase and Progressive averages a nearly $1,000 increase.

Since insurance premium increases can vary significantly depending on countless factors, estimating what you might expect to pay after an accident can be challenging. Regardless, it’s safe to assume you could have to pay at least a few hundred dollars more per year toward your premium.

Car insurance companies base your rate on how much of a risk you are for them to insure. Before an accident, you’re less chancy to insure, which means your insurance provider is less likely to pay for damages. After an accident, you become a higher risk, especially because you’re more likely to get into another accident that your insurance will have to cover. Because your insurance company is taking a more significant risk insuring you, your rate will likely go up to compensate.

While an increased premium may feel like a punishment for getting in an accident, your insurance company is merely adjusting your rate based on the new risk you present. Luckily, your insurance rate will eventually decrease, especially as you go longer and longer without another accident.

Your car insurance rates may increase by different amounts depending on the claim you file and the type of accident you’re in. In most cases, any accident on your record will affect your insurance rate. Some providers will still increase your premium regardless of who was at fault. If you weren’t at fault, you might only see a slight increase in your rate. However, some insurance claims, specifically those in which you’re at fault, are sure to make your premium skyrocket. Here are a few examples of claims that can lead to a significant increase in insurance premiums.

While no one wants their insurance rates to increase, you should still file a claim in these situations. Your insurance protects you in these situations and can cover some, if not all, associated damages.

As mentioned above, most accidents will cause your insurance rates to increase. However, there are a couple of instances where that might not be the case. Depending on your provider and coverage, you may avoid increased rates after an accident where you weren’t at fault, or the other driver is at fault. You may not be at fault if:

Some car insurance providers offer accident forgiveness programs. These can waive your first at-fault claim to prevent your premium from increasing. While these programs vary among providers and states, you can typically only waive one claim within three to five years. Eligibility can vary widely, depending on your driving history and how long you’ve been with your provider.

For example, some insurance companies may require an accident-free driving record for the past five years or be a customer with them for several years to qualify for free accident forgiveness. In these cases, accident forgiveness rewards drivers for being loyal to their insurance provider and maintaining a clean accident record.

Most accident forgiveness programs also offer the option for drivers to pay an extra cost to add accident forgiveness to their insurance coverage. Rather than wait to qualify for free, you may be able to pay to participate in these programs. Be sure to ask about your options, as some providers have limitations for new customers or drivers.

Overall, accident forgiveness programs can be valuable because they help prevent your premium from increasing after an accident. These programs are especially beneficial for drivers who get into an accident for the first time, as they won’t face additional costs.

An accident can affect your car insurance rates for several years. The more time that passes after an accident, the less impact it will have on your rates. You’ll see the highest increase after the first renewal period following the accident. Your premium should decrease after each year. The longer you go without another accident, the faster your premium will decrease.

Depending on your provider, your rates will typically return to normal after a few claim-free years. As more time goes by, your insurance provider will start seeing you as less of a risk and lower your premium. If you have another accident while waiting for your premium to decrease, you’ll see another increase, affecting your rates even longer.

While an accident will only affect the cost of your premium for a few years, your insurance provider will likely keep a record of it for much longer. How long an at-fault accident stays on your insurance record depends on your insurance provider and the accident’s severity.

Each state’s department of motor vehicles determines how long an accident stays on your driving record, meaning the length of time varies from state to state. Most states will keep accidents on your record for at least a few years. Some states have different rules that may keep the accident on your record longer.

More serious accidents, like those involving DUIs, typically stay on your record for several years. In some states, these accidents become permanent, especially when convictions occur. You’ll typically gain points on your license for accidents involving DUIs or reckless driving. After getting a specific number of points from accidents or violations, the state will suspend your license.

Depending on your state, you may be responsible for reporting your accidents to the DMV. You may need to follow rules about what types of accidents to report or when to tell the DMV about the incident. Other states may not require drivers to report accidents and will find out about severe accidents through the police who respond. Insurance companies typically don’t inform DMVs about accidents or claims filed.

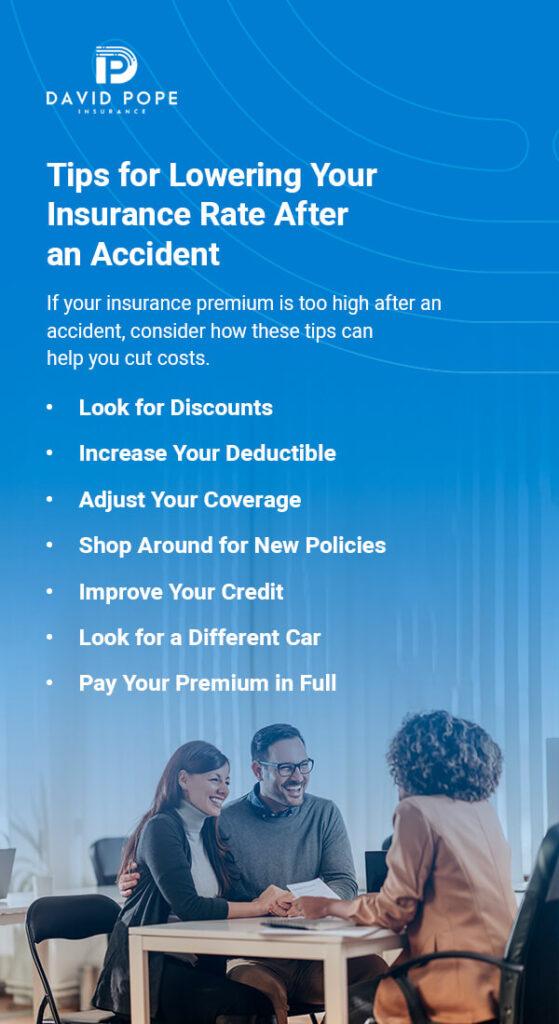

Despite having to pay the insurance increase after accidents, there are still some ways to lower your rate. If your insurance premium is too high after an accident, consider how these tips can help you cut costs.

Similar to accident forgiveness programs, many insurance companies also offer discounts that can lower your rate if you meet specific qualifications. Some popular discounts are safe driving, good student and multi-policy discounts. For example, some providers use programs that track your driving and allow you to earn rewards for safe driving habits like driving the speed limit or gradually braking rather than slamming on the brakes.

Many insurance companies offer multi-policy discounts or bundles to encourage customers to open several policies with them. For example, when you bundle a home and auto policy with the same provider, you may get a discount on your policies. If you use different providers for your insurance needs, consider bundling them if you can get a discount.

Your deductible is the amount you must pay before your insurance company will pay your claim. The higher your deductible, the lower your premium. While this option could save you money, you should be careful when increasing your deductible. If you raise your deductible, you’ll have to pay more out of pocket if you get into another accident or file another claim. Be sure your deductible is manageable in case you need to file another claim.

While it’s never ideal to have less accident protection, adjusting your coverage can make your premium more affordable. You’ll still need to meet your state’s minimum insurance requirements, though there may be some areas where you could reduce your coverage to lower your rate. If you need to consider this option, discuss your coverage with an insurance agent to find coverage selections you may be able to do without.

Every car insurance company handles accidents differently. Before your policy renews, you might want to shop around and find out how much a similar policy would cost with a different provider. Since you have a recent accident on your insurance record, it may still be challenging to find a new policy with similar coverage at the price you paid before the accident. However, remember that different companies offer various coverages and discounts, which may allow you to find a better price even with an accident on your insurance record.

Some insurance providers even specialize in offering policies and rates to drivers with less-than-perfect driving records. Looking for a new insurance provider never hurts, and you may be able to find lower rates. Get quotes from different companies to compare your options.

Many states consider your credit score when determining a price for your policy, since it helps them determine how likely you are to make timely payments. Improving your credit score can help lower your car insurance rates. To do so, pay off your debt, make payments on time, only spend within your limits and review your credit report to address any issues. Improving your credit score can be financially beneficial in several ways, so now’s a good time to start!

Your car’s make and model can affect your insurance rates. Insurance companies rate every vehicle differently depending on various factors, including materials, repair costs and safety ratings. Generally, expensive cars cost more to insure because they are pricey to repair after an accident. Looking for a vehicle that costs less to insure can be an effective way to lower your premium.

Some insurance companies may offer a discounted price for drivers who can pay their full premium. Your insurance provider may offer savings when you pay for a term of coverage in full rather than making monthly payments. For example, if your insurance rate costs $100 a month, you’d pay $1,200 for car insurance over a year. If you can pay your premium in full at the beginning of the year, your insurance company may discount the price to $1,000 for the entire year.

If your insurance provider offers this type of payment plan and you can afford to pay for your premium upfront, you could save money over time.

Understanding your car insurance after an accident can be challenging. Here are a few more FAQs you may have on your mind.

Every driver has different insurance needs, especially regarding your budget. At David Pope Insurance, we understand your unique auto insurance needs, so we offer custom quotes to meet your requirements and budget. We’re flexible, working with drivers with various driving records and accident histories.

To find out how we can help you, request a quote today or contact us for more information.