If your home mortgage is no longer working for your financial situation, you may want to consider refinancing. Refinancing a mortgage doesn’t have to be difficult or overwhelming. In fact, the processes of securing a mortgage and refinancing a mortgage are quite similar.

Refinancing a home mortgage during an economic downturn may be an especially appealing choice for your finances, though the process may be delayed depending on national circumstances. We’ve compiled this comprehensive guide to help you decide whether refinancing is the right choice for you and to walk you through how to refinance a mortgage.

Mortgage refinancing refers to replacing your existing home mortgage with a new loan. Refinancing offers opportunities that might appeal to many homeowners, including lowering their interest rates, switching to a fixed-rate mortgage or paying off their loan faster. Let’s dive into how mortgage refinancing works.

When you initially purchase a home, you buy a mortgage from a lender. In return, the lender pays the seller the cost of the property. When you refinance, you obtain a new home mortgage from either the same lender you worked with for your first loan or a different one. Rather than this money going to pay for a property, this new mortgage goes toward paying off the balance of your previous mortgage.

Refinancing a home mortgage can allow you to:

The mortgage refinancing process works similarly to securing your initial mortgage. When you apply for mortgage refinancing, you will go through the application, underwriting and closing process again. The new mortgage will also come with closing costs.

Just as you qualified for your original loan, you’ll need to be eligible for the mortgage. The lender you work with will review your financial situation to assess your risk level and determine the most favorable interest rates you can receive.

The new mortgage may have a lower interest rate or different terms. It may also reset your repayment schedule. For example, if you had a 30-year mortgage for five years and refinance to a 20-year loan, you’ll pay it off five years faster than you would have repaid the original mortgage.

Before refinancing a mortgage, homeowners must compare how long it will take to pay off the mortgage with how long they plan to stay in the home. New interest rates, adjusted monthly payments and how much equity remains in the house will also affect the decision.

Several factors are worth considering when determining the right time to refinance a mortgage. Here are some circumstances in which refinancing could be the right move:

The type of loan you have will determine how long you’ll need to wait before you can refinance. Most lenders and banks require that borrowers maintain an existing mortgage for a “seasoning period” before refinancing, usually at least six months. If you are considering refinancing, you should check with your lender about the details and restrictions.

As you consider refinancing your mortgage, you may wonder whether it would be better to work with your original lender or find a new one. Generally, going through the original lender makes the most sense. However, refinancing with your original lender is not required. It is easier for lenders to retain a customer than find a new one, which means lenders will usually not require a property appraisal or new title search.

Most lenders may also offer their borrowers a better price when they are looking to refinance. Your odds of refinancing at a lower interest rate tend to be better if you stay with your original lender.

Market trends also influence the best time for refinancing a mortgage. For example, changing interest rates could impact the long-term cost of a refinanced mortgage. A 30-year fixed-rate mortgage has an average interest rate of 6.3% as of December 2022. While that’s lower than November’s average interest rate of over 7%, rates are still more than double what they were at the beginning of 2020.

Switching to a fixed-rate refinanced mortgage when interest rates are high could leave you stuck paying higher rates even if they start to trend lower. However, a fixed-rate mortgage could be beneficial if interest rates continue rising. Ultimately, favorable refinancing mortgage rates are at least one percentage point below your current rate.

Many lenders require a specific credit score to refinance a mortgage or offer more favorable interest rates to homeowners with a better score. It’s also crucial to consider changing mortgage terms and how long you may have to pay off your home.

If you are considering refinancing your mortgage, the following are some of the questions you may want to ask yourself:

Homeowners may have several reasons for refinancing. Do you want to refinance to a lower interest rate or reduce your monthly mortgage payments? Do you want to switch from an adjustable interest rate to a fixed interest rate? Do you want to use some of your home equity to finance major renovations?

Establishing your goal can help you pursue the right refinancing terms for you. For example, if you want to pay off your mortgage as quickly as possible, you may want a loan that has a shorter term with monthly payments you can still afford.

Borrowers who are the best candidates for refinancing a mortgage have a stable income and a good credit score. Your lender may also consider your debt-to-income ratio. If this ratio is high, it may affect your ability to refinance your mortgage or the interest rate you receive.

Assess your budget and life situation to determine if refinancing would make financial sense for you. How long do you plan on staying in your home? How many years are you away from retirement? Do you want to refinance for a longer term or a shorter term?

The cost of refinancing a mortgage depends on your home’s value. You’ll also have to pay your lender’s fees, including a mortgage application fee, origination fee and credit report fee. A mortgage refinancing typically costs between 2% and 6% of your loan’s total value.

If you use the same lender as your original mortgage, you may not need to pay for a home inspection and appraisal. Additionally, you may not always have to pay closing costs for a mortgage refinance. However, those costs will be spread out over the life of your loan in the form of higher rates.

Borrowers have a number of reasons for choosing to refinance. The benefits of refinancing home mortgage rates may include:

If you intend to live in your home for several more years, decreasing your interest rate and monthly payment can be advantageous. One of the best reasons to refinance is to obtain a lower interest rate. When interest rates drop, this can be the ideal time to refinance. Through these monthly savings, you may be able to recover the costs of refinancing over the long term.

If you do not plan on living in the home for longer than a few years, you may choose to refinance to an adjustable-rate mortgage, which can provide a lower monthly rate and payment. A shorter term may allow you to avoid an increase in your interest rate when your rate adjusts.

When your home increases in value, you may be able to use that equity for other major purchases, such as:

Cash-out refinances are simple and may even be tax-deductible.

While some mortgages allow borrowers to purchase a property with little to no down payment, these mortgages tend to require that borrowers pay private mortgage insurance. PMI protects lenders in the event that a borrower defaults on a loan. Borrowers may be able to cancel their PMI when the value of the property increases and the balance on the loan decreases.

While balloon programs can provide a lower initial rate and monthly payment, they require you to pay the mortgage in a lump sum after the term is over. When you refinance from a balloon loan, you can secure a new fixed-rate mortgage.

Many homeowners switch to a fixed-rate mortgage when refinancing, which can protect against market fluctuations. After an initial period, the interest on adjustable-rate mortgages shifts to a “floating” rate that can change with the market. As a result, your interest rates might be much higher after five years than when you secured the mortgage. A fixed-rate mortgage keeps your interest rates fixed throughout the life of your loan.

Some homeowners use a cash-out refinance to tap into some of the equity built up in their homes. This type of refinancing consolidates your mortgage with other forms of debt, like student loans, into a single payment. You can also use cash-out refinancing to finance a home improvement or fund other large expenses at a relatively lower interest rate.

Refinancing a mortgage isn’t the right choice for all borrowers. Mortgage refinancing risks include:

One of the biggest risks borrowers face when refinancing their mortgage is incurring penalties from paying down their existing mortgage with their home equity credit. Many mortgage agreements include a provision that allows the company to charge borrowers a fee for doing so. Before you finalize an agreement to refinance, review the terms to ensure the refinance will cover the penalty if necessary.

When you refinance a mortgage, you may have to pay high closing costs. While you may be able to negotiate costs, you should also be wary of banks and lenders that advertise mortgages with no closing costs. These plans tend to come with a higher interest rate.

In some states, homebuyers are given an additional layer of protection so they can’t be sued by a bank in the event of a foreclosure. If you were protected by your original mortgage, you could lose your protection if your refinanced mortgage does not include it.

A lower interest rate is not the only consideration when determining whether to refinance. If the lower interest means you’ll pay the loan off over a longer period time, it may cost the same or more than your existing mortgage. Calculate your amortization schedule to determine if paying the loan over a longer period of time would save you money or if you can obtain a shorter term.

If you want to move soon or your life circumstances lead you to move sooner than you anticipated, refinancing may not be the right choice for you. Moving within a few years after refinancing typically means you won’t recover the closing costs. Most often, refinancing a mortgage is for homeowners who intend to live in a home for several years.

Applying for mortgage refinancing requires a hard inquiry on your credit report, which can temporarily lower your credit score a few points. Multiple inquiries during a relatively short period generally only count as one. However, your credit score could take a hit if you’re shopping around for the most favorable rate from different lenders.

Refinancing your mortgage to lengthen the term can also lead to paying more interest over the life of your loan. Even if you switch from an adjustable-rate mortgage to a fixed-rate loan, a longer term could mean paying more interest and cost more overall.

Refinancing your mortgage doesn’t mean you can immediately stop paying on your existing loan. Missing a payment on your current mortgage during the refinancing process can affect your credit score. It’s essential to continue paying your old mortgage until the balance reaches zero.

Do you believe refinancing may be the right decision for you? Since you’ve already been through the process of securing a mortgage, the process of refinancing will be familiar.

Refinancing a mortgage generally takes between 30 and 45 days to complete, although this timeline can vary significantly. The process can become even more drawn out if you need third parties to appraise or inspect your home. How long the refinancing process takes depends on your financial situation and your home’s value.

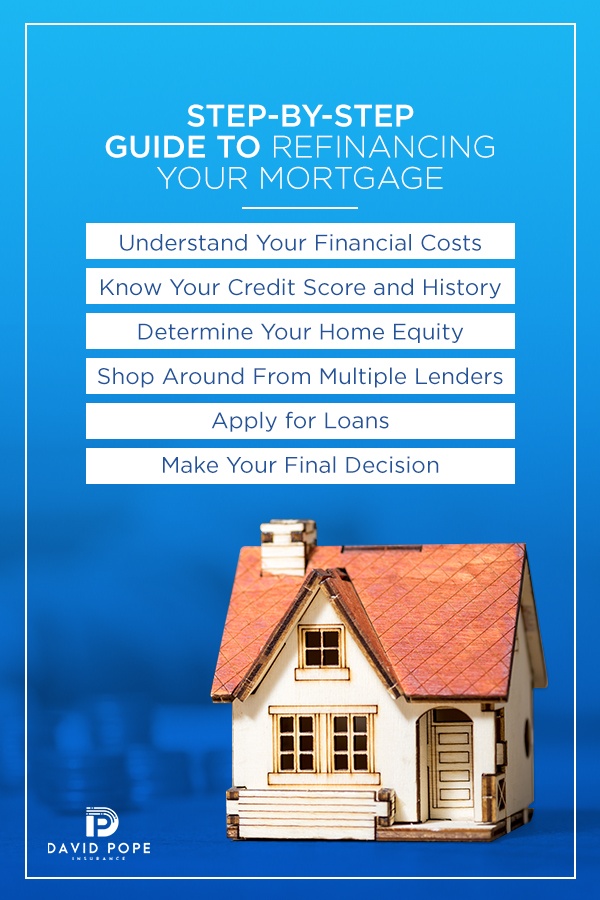

Follow these steps to refinance your mortgage:

Understanding your financial costs for refinancing is essential for determining whether refinancing is worth it. The cost of refinancing a mortgage typically includes:

To determine if a lower interest rate will allow you to recover the costs you incur through refinancing, you should understand the exact financial costs. If you are lowering your interest rate, but you are also restarting a new 30-year mortgage, will you end up paying more over the term of the mortgage? Does it make sense for you financially to pay more in total over the term of the loan if it means you are paying less per month? The savings should outweigh the costs for you to pursue refinancing your mortgage.

You should also establish a clear goal for refinancing your mortgage — whether your reason is shortening your loan term, reducing your monthly payment or tapping into your home equity for debt repayment or home repairs.

Having a good credit score and credit history can offer a lot of perks, especially when you’re considering refinancing your mortgage. A good credit score helps your odds of approval for a mortgage refinance and also determines what interest rate your lender will be willing to offer.

The higher your credit score is, the lower your interest rate will be. If your credit score has decreased since you obtained your existing mortgage, refinancing may not be beneficial to you. If your credit score has improved since then, refinancing your mortgage may be advantageous.

To find out what your credit score is, you can check your FICO score for free. When you know your score, you can determine where you stand within the following credit score categories:

A mortgage lender may approve your application to refinance if your score is at least 620, but a very good or exceptional score is more likely to get you the lowest rates. Along with your credit score, your lender may also consider your credit history, credit utilization ratio, recent credit applications, foreclosures and bankruptcies.

Checking your credit report will allow you to ensure there are no inaccuracies. If you find something on your credit report that is incorrect or fraudulent, you can dispute this with the credit bureaus. If you are determined to be correct, the incorrect item will be removed or fixed. This can make it easier for you to obtain a better interest rate for your new mortgage.

The next step to refinancing your mortgage is determining your home equity. Home equity refers to the value of a home that is in excess of what is owed on the home. To determine the equity you have in your home, check your current balance on your mortgage statement. You can then estimate the value of your home by checking online or requesting that a real estate agent runs an analysis.

For example, if you owe $180,000 on your home and your home is worth $200,000, your home equity is $20,000. The more equity you have in your home, the more likely you may be to secure a better interest rate and pay fewer fees, as this makes the loan less risky to the lender.

One of the best ways for borrowers to obtain a lower interest rate is to shop around for mortgage refinancing from multiple lenders. You do not have to select your current mortgage provider to refinance your mortgage, especially if you find better terms with another lender.

The criteria used to determine interest rates for home mortgages varies by lender. As a result, you may be eligible for a lower rate from one lender compared to another. Fees and closing costs also vary by lender, so when you compare several options, you can maximize your savings.

You may want to obtain at least three quotes from different lenders so you have a better idea of the refinancing terms you qualify for. You may be able to use these quotes to negotiate lower fees and a lower interest rate. Submitting applications to several lenders should not impact your credit score negatively as long as you submit your applications in a short period of time.

The next step in the process of mortgage refinancing is applying for loans. If you are approved by a lender, you can move forward with applying to refinance your mortgage. You may be able to apply for a loan online or contact a loan officer to apply. The length of the refinancing process depends on the specifics of your situation. For example, if there is an inaccuracy on your credit report, if you change jobs or if there is a widespread national crisis, it could slow the refinancing process.

The last step in the process is making your final decision. Because a mortgage is such a large financial commitment, take your time reading the contract and ensure you fully understand the terms. Check on any fees and whether you will be charged a penalty for paying off your loan early. If you are unsure of a term, ask the lender for clarity.

Sometimes, a lender may attempt to pressure you into signing quickly. If you feel like you’re being pressured or rushed during the process, you may want to consider working with another lender. Though refinancing a mortgage can be a simple process, it encompasses several important financial factors, including the potential for savings and the costs of refinancing. Take your time with researching your options and shopping around. Review the refinancing terms carefully and assess the long-term outlook to determine what mortgage is the right fit for you.

Depending on their finances and goals, homeowners may have several types of refinancing options available. Consider each mortgage refinancing option carefully.

A rate-and-term refinance changes the loan’s interest rate, term or both. Homeowners choose this refinancing option to reduce their monthly payments, save on interest or pay their loan faster.

In a cash-out refinance, the homeowner refinances their mortgage for a larger sum than what they owe and receives the difference in cash. This refinance option might be good when you want to fund home improvement projects or pay other debts while still refinancing your mortgage.

A cash-in refinance involves the homeowner paying a large sum toward the loan amount. This refinancing option can lower your monthly payment or reduce your interest rate.

A no-closing-cost refinance spreads the homeowner’s closing costs over the length of the loan instead of requiring them upfront. This type of refinancing increases monthly payments and may raise interest rates. A no-closing-cost refinance appeals to homeowners who only plan to stay in the home for a short time.

In a reverse mortgage, homeowners age 62 or older can withdraw their home’s equity in monthly payments. The homeowner won’t have to repay the lender for the loan until they leave the house. If you qualify for a reverse mortgage, it could help you pay medical bills or increase your retirement income.

Debt consolidation refinancing provides homeowners with cash they can only use to repay other non-mortgage debt. You may choose debt consolidation refinancing if you need to pay credit card debt.

Lenders have their own sets of fees associated with mortgage refinancing. This means the exact fees charged and the amount of the fees will vary from lender to lender. Your costs for refinancing may include the following mortgage refinancing fees:

The lower the costs and fees, the less time you will need to break even given the savings from the lower interest rate. Typically, a lender will provide a loan disclosure that includes an estimate of the closing costs. Itemize the fees listed and compare them to the costs from the other lenders you contact.

When it comes to refinancing, homeowners insurance is often required by lenders to ensure a financed property is protected. The following are a few commonly asked questions about homeowners’ insurance during refinancing:

You do not need to stick with the same insurance company for your homeowners insurance. Refinancing can often be a great time to find an insurance company that is a better fit for you.

Homeowners insurance requirements vary from lender to lender. Some lenders may be more flexible, while others may have stricter requirements. Your homeowners insurance should protect your home from natural disasters, accidents, fire and theft, but a lender may require you obtain separate flood insurance if your home is located in a flood zone.

Timing tends to vary by lender. While some lenders will require you to obtain homeowners insurance when the refinancing process is almost finished, other lenders have a loan commitment that requires borrowers to have insurance much earlier in the process. Your agent or refinancing packet should inform you about the process of securing homeowner’s insurance.

If you’re planning to refinance your mortgage, you may want to obtain homeowners insurance. At David Pope Insurance, LLC, we can customize a policy that suits your needs. As a local, family-owned business, we understand what your home means to you and your family. For more than 15 years, we’ve helped homeowners like you get the coverage they need while keeping costs low. Contact us at David Pope Insurance to get a quote for homeowners insurance today.