If you’re considering making home improvements or repairs, you should first determine whether any of these upgrades are tax-deductible. Deductions can save you money when filing your tax return. Here, we’ll cover the information you need to know regarding home improvements and repairs to answer your questions and address your concerns before you start the process.

You can subtract some expenses from your personal or business taxable income, resulting in a lower tax liability. In other words, tax-deductible expenses or contributions reduce the amount of your income that is subject to taxation. Common examples of tax-deductible expenses include:

Not all expenses are tax-deductible, and some deductions may have limitations or restrictions. Tax laws can change frequently, so consult with a tax professional or review official tax guidelines to ensure you accurately claim deductions.

Home improvements and home repairs are two different things, but both are essential aspects of maintaining and upgrading a house.

Home improvements involve making upgrades or additions to enhance a house’s value, aesthetics and functionality. These can include projects like:

The goal of improvements is to enhance the home in some way, whether it’s to make it more comfortable, efficient or aesthetically pleasing.

Home improvements can have tax-related implications. Here are some essential things to remember.

The tax implications of home improvements can be complex and vary depending on the specific circumstances. Consult with a tax professional or financial adviser before making any significant decisions.

Home repairs typically involve fixing something such as a leaky roof, a malfunctioning air conditioning system or a cracked foundation. The goal of repairs is to restore the home to its original condition or prevent further damage. Home repairs are often urgent and need immediate attention to avoid further problems.

Home repairs generally do not have any direct tax implications. Repairs are part of the routine maintenance and upkeep of your home, and as such, they are not typically eligible for any tax deductions or credits.

However, if you use your house for business purposes, such as if you operate a home-based business or dedicate an area as a home office, you may be able to deduct the cost of repairs as an essential business expense.

Additionally, if you rent your home to someone else, you might deduct the cost of repairs as a rental expense. These can include essential upkeep that keeps the property in good condition and maintenance to address normal wear and tear.

Some fixes are overall improvements, such as replacing the entire roof or upgrading the electrical system. These are generally not deductible as a current expense, but you may add them to your home’s cost basis and use them to reduce capital gains taxes when you sell.

In general, it’s wise to keep records of any repairs or improvements you make to your home, along with the associated costs. Using these notes, you can determine if you are eligible for any tax benefits. They can also help you calculate your home’s cost basis for tax purposes.

Essentially, repairs are necessary to keep a home in good working order and prevent further damage, while improvements are optional upgrades that can add value and enhance your property’s livability.

Have Questions? Contact Us Today!

Capital improvements are permanent enhancements or additions made to a home that increase its value, improve its functionality or extend its useful life. These investments may be tax-deductible.

Examples of capital improvements to homes include:

Capital improvements differ from routine maintenance or repairs because they involve significant expenses and provide long-term benefits. They can increase your home’s value and make it more appealing to potential buyers if you decide to sell.

Capital improvements to your home can have tax benefits and consequences. The following are some critical aspects to remember about capital improvements and taxes.

In general, home improvements are not tax-deductible, but there are some exceptions.

If you are making home improvements for medical reasons, such as modifying a bathroom to accommodate a disability, you may be able to claim a tax deduction for the expenses as a medical expense. However, you must meet specific criteria and provide supporting documentation.

Additionally, if you make environmentally friendly upgrades, you may be eligible for tax credits. For example, if you install solar panels, a geothermal heat pump or energy-efficient windows or doors, you may be able to claim a tax credit for a portion of the costs. However, these credits are typically only available for a limited time and have specific eligibility criteria.

Consult with a tax professional to determine if you are eligible for any tax deductions or credits related to home improvements.

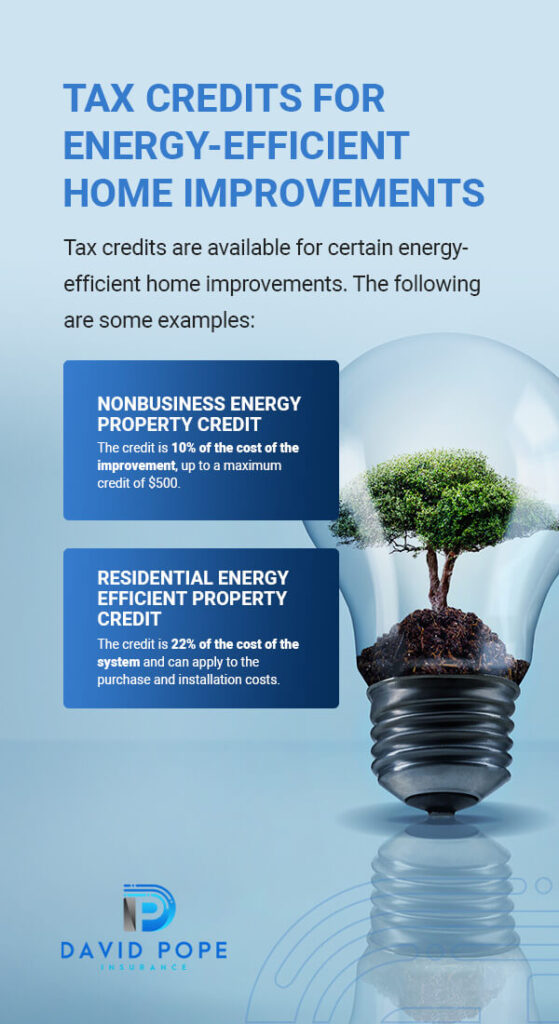

Tax credits are available for certain energy-efficient home improvements. The following are some examples:

These tax credits have specific eligibility requirements and limitations, and the rules and amounts may change from year to year.

Generally, home repairs are not tax-deductible. The IRS considers home repairs to be a personal expense and, therefore, not eligible for tax deductions. However, in some situations, home repairs may be partially tax-deductible.

If you updated your home for medical reasons, the expenses may be partially deductible as a medical expense on your tax return. Additionally, if you are a landlord maintaining or improving a rental property, the costs may be deductible as a rental expense on your tax return.

If you make upgrades such as adding a new room or renovating a kitchen, those expenses may be eligible for a tax deduction if they meet specific criteria. Home improvements that add value or improve your property’s energy efficiency may qualify for a tax credit or deduction.

If you make home improvements for medical reasons, such as adding a wheelchair ramp, modifying a bathroom to accommodate a disability, or installing a lift, you may be able to claim a tax deduction for the expenses as a medical expense on your income tax return.

To qualify for the deduction, the home improvements must be medically necessary, which means a medical professional must prescribe them to treat or alleviate a specific condition.

For example, if your AGI is $50,000, the cost of your medically necessary home improvements must exceed $5,000 to be deductible.

Keep detailed records of the expenses, including receipts and invoices, along with a letter from your doctor outlining the medical necessity of the improvements. You should consult with a tax professional to determine if you qualify for the deduction and how to claim it on your tax return.

Home improvements can impact insurance rates in a few different ways. Here are some examples.

Notify your insurance company of any significant changes to your property so they can adjust your coverage and premiums accordingly. In some cases, you may need to purchase additional coverage or increase your liability limits to ensure sufficient protection. Learn more about how home improvements can affect insurance.

There are several financial benefits of home improvements.

Home improvements can provide short-term and long-term financial benefits and are an investment in your home and future. Track, organize and keep records to prepare for putting your property on the market.

At David Pope Insurance, we can meet your personal and commercial insurance needs. Contact us to learn more about tax deductions and how improving your home can affect insurance.