According to the Federal Emergency Management Agency (FEMA), 6 in 10 households experience at least one financial emergency in a year. A financial emergency is any large unexpected expense or loss of income. Yet, a third of American families do not have any savings.

Unexpected expenses can have a profound impact on your life and financial health. You can’t always predict when your basement will flood or your car will need a new engine. It’s critical to prepare for life’s surprises.

In this chapter, we’ll show you how to prepare for financial emergencies and create an emergency fund for your household. If you’re ready to explore insurance options to protect your family and your assets, let us know. At David Pope Insurance, we make sure you have the coverage you need to be ready for the unexpected.

No one wants to be thrown into an emergency that could drastically change their financial future. Rather than worry about financial troubles, you can be ready for just about any challenge that comes your way. Use the following tips to prepare for curveballs:

Creating a household budget and sticking to it is an important part of emergency preparation. Having a budget and controlling how you spend and save money helps you reach financial goals, such as building an emergency fund or saving for home repairs. If you haven’t done so already, make it a priority to list your household expenses and identify areas where you can cut back. Use the money you save to build an emergency fund.

Emergencies pop up when you least expect them. A household member could lose income, a vehicle might suddenly need a costly repair, or a storm could knock down a tree in the yard. When life’s inevitable surprises arise, your emergency fund will be there waiting for you.

During a natural disaster, credit cards and ATMs might not work. To ensure you can still get food, gas and other necessities, it’s a good idea to keep cash on hand. Stash enough money to cover a month of expenses in a waterproof and fireproof safe, and make sure to include small bills.

During your free time, learn new skills to add to your resume and give yourself an edge in the job market. For example, you might sharpen your typing skills or learn a new computer program. There are plenty of free courses online to help you develop and practice relevant skills. By expanding your skill set, you’ll have more options if you need to find a job quickly.

Consider creating multiple streams of income so you can have a bigger cushion if there’s an emergency and depend less on your current employer. You can take a second job, turn a hobby into a business or sell digital products online. In today’s world, there are dozens of ways to make money on the side. You don’t necessarily have to keep your other jobs forever, but they can help you build an emergency fund faster.

You can’t always keep unfortunate events from happening, but you can prepare for disasters and protect everything you worked for with insurance. Insurance is a critical component of financial health. Without insurance, events like theft, illness, car accidents or natural disasters could deplete your savings or put you in a financial crisis. Plus, most states require car insurance, and you’ll likely need homeowners insurance if you took out a loan.

To ensure you and your family have adequate protection, review your health, home and auto insurance policies. Keep in mind that homeowners insurance typically does not cover damage caused by floods or earthquakes. You’ll need to get flood and earthquake insurance separately, which your insurance agent can help you with.

Other insurances to consider are disability insurance, which provides an income if you cannot work due to an injury or illness, and life insurance to bring you and your loved ones peace of mind. Your insurance agent can help you find all the coverages your family needs for adequate protection at affordable rates.

It’s best not to depend on a credit card or loan to cover emergency-related costs. However, it’s still important to maintain good credit just in case you need extra help. Having a decent credit score means you’ll qualify for better interest rates. This can help you pay off debt faster and spend less on interest. You’re also more likely to get approved for a loan or a new credit card if necessary. You can improve your credit score by paying bills on time and reducing your current debt.

During an emergency, you might not have time to research the various resources available, so you’ll want to familiarize yourself with assistance programs before disaster strikes. This may include looking into unemployment payments or your community’s disaster recovery resources. Consider emergencies that might happen and think of all the ways you can connect with individuals and organizations for help.

In the aftermath of an emergency like a natural disaster, you’ll need access to household information. Your household’s documents will help you rebuild your home after a disaster and locate essential resources. Keep vital records, such as forms of identification, household contact information, insurance policies, repair receipts and other financial documents in a waterproof, fireproof safe. FEMA provides forms and checklists to help you build an Emergency Financial First Aid Kit.

Take photos or videos of your home and valuable belongings. Write down descriptions of these items and their related costs. Your photos or videos will help you file a homeowners insurance claim if your home or belongings need to be replaced or repaired. Store these items digitally and in your safe, along with your household’s essential documents and emergency cash.

All homes need repairs eventually. A standard homeowner’s insurance policy will not cover repairs resulting from everyday wear and tear. Make a list of major repairs you may need to make to your home and car and start saving. That way, you’ll be financially ready when you need to address an emergency repair, and you can keep yourself out of debt.

As a general rule, you should try to have three to nine months of living expenses in your emergency fund. Your emergency fund should cover necessary expenses such as food, health care and housing costs. You don’t need to include money for a vacation or entertainment in your emergency fund.

If you don’t have enough money for at least three months of living expenses, realize it’s OK to start small. You might make it a goal to save $500 at first. Once you reach that goal, plan to save enough to cover a month of expenses. Set aside whatever you can afford each week and let it build over time.

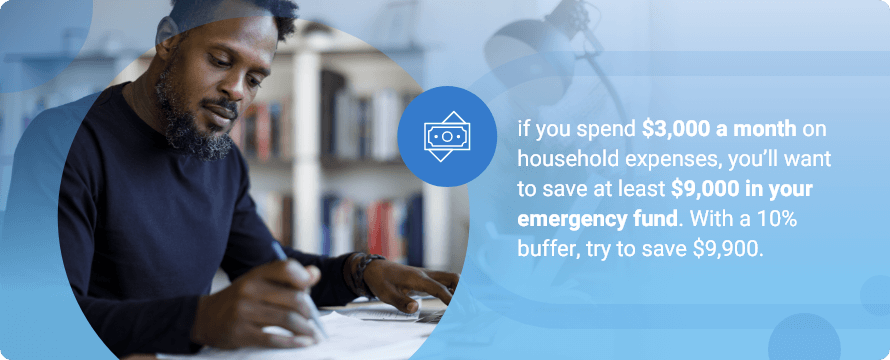

To calculate your emergency fund, first estimate your monthly expenses. It’s better to overestimate your costs and create a buffer if you can. So, if your monthly expenses are $3,000 a month, and you add a 10% buffer, you’ll want to save at least $3,300 to cover one month if there’s an emergency.

Then, decide how many months you want to be able to cover with your emergency fund. This depends on your comfort level. If you’re comfortable with an emergency fund covering three months of living expenses, multiply your estimated monthly total by three. For example, if you spend $3,000 a month on household expenses, you’ll want to save at least $9,000 in your emergency fund. With a 10% buffer, try to save $9,900.

Take Charge America provides an emergency fund calculator you can use to get started.

According to the 2020 State of Home Spending survey conducted by HomeAdvisor, homeowners spent an average of $3,192 on maintenance projects and $1,640 on home emergencies. If you include home improvement costs, homeowners spent an average of $13,138 total in 2020.

Not every home repair will set you back, especially if you have an emergency fund. However, some require a substantial investment, so you’ll want to start saving for home repairs as soon as you can. The most expensive home repairs include:

Some of these pricey repairs can be prevented or delayed by properly maintaining your home. It’s much less expensive to repair a leak, for example, than to fix water damage.

To help prevent expensive home repairs, it’s worth starting a savings account for basic home maintenance. Your home maintenance budget should equal 1% of your home’s value each year. For example, if your home is worth $250,000, you’ll want to save $2,500 a year or about $208 a month for maintenance costs. You may need to save more if you own an older home or if your property needs a lot of work.

Your home maintenance savings should be kept separate from your emergency fund. Depending on your needs, you may also want to create a fund specifically for emergency home repairs. You can create as many savings accounts as you need to stay organized and allocate funds to the right places.

If an unexpected repair arises that you can’t afford, you still have options. It’s better to address the repair ASAP rather than let it get worse and lead to further damage. Here are various ways to pay for home repairs if you need assistance:

You might pay for the repairs by using your home’s equity. Your home’s equity is the difference between what you still owe on your house and your home’s value. For example, if your home is worth $150,000 and you still owe $100,000, you have $50,000 of equity.

You can access your home’s equity through a loan or line of credit. With a home equity loan, you’ll get a fixed amount of money upfront. The amount you can borrow with a loan is typically limited to 85% of the equity you have in your home. You’ll pay the amount back in monthly installments with interest.

With a home equity line of credit, you borrow money only when you need it, just like with a credit card. You pay back what you borrow.

If you’re not comfortable tapping into your home’s equity, consider asking about financing options at a home improvement store. This might be the way to go if you plan to make repairs yourself or pay for labor out of pocket.

You may be eligible for government assistance to help with home repairs. Eligibility for home repair assistance typically depends on income level, age, property type and location. It’s best to look into government assistance programs before you need one so you know which ones you can apply for.

Your homeowners insurance may cover the repair, depending on your policy and the cause of the damage. For example, a basic homeowners insurance policy covers roof damage caused by natural forces, like hail or wind. Read your policy to review your deductible, coverage limits and exclusions. If you have questions, reach out to your insurance agent.

You might borrow money from a bank or credit union in the form of a personal loan. You can typically use personal loans for just about anything, including home repairs. Like a home equity loan, you’ll receive the money in a single payment, and you’ll need to pay it back in monthly installments plus interest. You might prefer this option if you don’t want to use your home as collateral.

As a last resort, you might use a credit card to pay for repairs. Credit cards typically have higher interest rates than other options and can quickly accumulate debt. However, if you qualify for a credit card with a low introductory annual percentage rate and can pay off the amount you use during the promotional period, it may make sense to use a credit card for an emergency.

According to the Report on the Economic Well-Being of U.S. Households in 2018, a quarter of adults did not get necessary medical care because they couldn’t afford it. In 2017, a fifth of adults had significant, unexpected medical bills to pay.

No one is entirely immune to illnesses or injuries, even individuals who live healthy lifestyles. For many people, medical costs are a heavy burden. To ensure you have the funds necessary to get emergency care for yourself or family members, budget for medical expenses.

Setting aside money for unexpected medical expenses should be part of your emergency fund. Unexpected medical expenses are hard to predict, but you can estimate how much a medical emergency might cost and add that to your emergency fund. For example, consider if you have enough saved to cover your deductible if you have to stay in the hospital. Say you need to meet a $1,000 deductible before your insurance kicks in. In this case, plan to have that amount in your emergency savings, even if you can only set aside $10 a month.

A family disaster plan shows you how to respond to a disaster or an emergency like a house fire or natural catastrophe. During a disaster, you may not have much time to evacuate, or you might lose power for an extended period. Your family disaster plan prepares you for catastrophes and unexpected events to help keep your family safe.

The first step to household disaster planning is to consider the natural disaster risks in your area. Homeowners in Missouri, for example, have to be prepared for natural disasters like floods, tornadoes and severe storms. Consider how you’ll respond to emergencies that require you to seek shelter elsewhere or evacuate your area. Also, plan what you’ll do if family members get separated during the emergency.

The American Red Cross has a family disaster plan worksheet you can fill out and keep on hand. Go over the plan with household members every six months or as needed.

Make sure to consider how you and your family will respond to disasters that can start within your home, like a fire. Ensure all household members know how to escape from every room in the house, and establish a meeting spot outside. The American Red Cross recommends that families hold fire drills at least twice a year.