When it comes to home insurance, there’s no shortage of common myths and misconceptions. Many homeowners struggle to identify what’s fact from what’s fiction when navigating their insurance options, and the prevalence of this insurance misinformation can lead many policy buyers to make decisions that affect them negatively later on. If you expect your homeowner’s insurance to cover flooding or you’re worried making a claim could raise your rate, keep reading to learn more about the insurance myths we’re demystifying.

At David Pope Insurance Services, LLC, we receive many questions about home insurance facts, and we want to help you understand what you can expect from your coverage. To ensure you know how to navigate the many insurance options available to you and understand what you can expect from your policy, consider the facts versus the myths we’ve busted below.

More Insurance Tips:

A home insurance policy usually covers roofs that need to be replaced after sudden damage, like a storm or an accident. When it comes to the age of a roof and insurance, however, the replacement of an old roof won’t be covered.

If your roof has exceeded its predicted expiration date, you won’t receive a payout from your home insurance policy for the replacement costs.

Roofs can be costly to replace, and if you rely on your homeowners insurance policy to cover the cost of your roof when it comes time to replace it, you may be in for a shock. You’ll need to save thousands of dollars to replace an old roof, and if you haven’t been saving up for the inevitable roof replacement, this could really set you back financially.

If a sudden accident or an act of nature damages or destroys your roof, your homeowners insurance will reimburse you for the cost of its replacement. Natural deterioration and roofs that are decades old, however, are not likely to be covered at all.

When damage occurs to your roof, keep thorough records of the damages and repairs. Take before-and-after pictures. You may also want to save for your roof replacement on your own instead of relying on your homeowners insurance policy to cover the expense.

Homeowners and renters alike face the possibility of their personal belongings being damaged or lost following a storm or a fire. If you want to protect the contents of your home, you should know that not all of the damaged or lost items are covered by insurance.

Part of the reason this homeowners insurance myth circulates is because many homeowners aren’t aware of the difference between Replacement Cost Value and Actual Cash Value for replacing the contents in their home with a claim. While Replacement Cost Value coverage will pay for the expense of replacing an item, Actual Cash Value will only reimburse you what the item was worth the day it was destroyed.

You may believe that if your personal belongings are damaged or destroyed, then your homeowners insurance policy will cover the cost to replace those items. Without the right coverage, however, you may receive a much lower payout than you were expecting and find yourself unable to repurchase many of the belongings you lost.

Typically, a homeowners insurance policy will provide coverage in multiple areas, including the dwelling, outlying structures like a shed or garage and your personal belongings. However, this doesn’t mean every item is automatically covered or at the value you may expect.

For homeowners, Actual Cash Value covers only what your belongings were worth on the day they were damaged or destroyed. Most home insurance policies also place limits on certain high-value items. To be compensated for the full value of your jewelry, for example, the items will need to be appraised and included as a rider on your policy. You will then have coverage for your jewelry in the event of a loss.

To cover the expense of buying new items as a homeowner, you must have Replacement Cost Value coverage. This coverage will help you replace your damaged, lost or destroyed personal belongings.

Though home insurance may cover loss due to theft for some of your belongings, not all of your belongings are automatically covered, regardless of how valuable they are.

You may have heard the myth that your home insurance will cover any and all items stolen from your home. However, in truth, there are some exceptions to the losses covered due to theft.

If you believe this myth, you could suffer a significant financial loss if your more valuable items are stolen and are not covered by your homeowners insurance policy. Without the coverage you need, you may struggle to replace your stolen belongings, especially if they’re costly.

Home insurance has limits on how much you can recover for certain valuable items after theft, including tech equipment, art collections and jewelry. For instance, if you have a wedding ring worth $10,000, but your coverage limit is $1,000 for jewelry, you would only be reimbursed a maximum of $1,000 if your wedding ring is stolen.

If you are concerned that you do not have enough coverage for your more valuable belongings, you may want to purchase additional coverage. You can purchase scheduled personal property coverage as an add-on to your home insurance policy, which can ensure your high-value items are fully protected.

Making an inventory list can both help you when you’re moving and prove you owned items prior to your move if you need to file a home insurance claim.

When you’re purchasing a home, moving and trying to obtain all the different insurance policies you need, you already have a lot on your plate, and you may believe an inventory list is an unnecessary waste of time. But the truth is that making an inventory list now can save you a lot of time and headache in the future.

Without an inventory list, it may be harder for you to prove that you owned an item in the first place when you need to file a claim for reimbursement of your belongings.

To determine whether you should be reimbursed for a lost, stolen or damaged item, your insurance provider will likely want some proof that you actually owned the item. Your insurance company will ask for a list of every item that was lost when you file a claim, so regardless, you’ll need to make this list if you face a covered peril.

By making an inventory list, you can make the claims process easier. You’ll have proof that you owned the items you’ve included on your claim, and you’ll be more likely to receive the reimbursement you need. Preparing your list of possessions ahead of time can ensure you remember every item and maximize your reimbursement.

Flooding can happen to just about anyone, even homeowners who don’t live in a flood zone or an area prone to flooding. However, many homeowners purchase homeowners insurance and believe this will protect them financially if their home is damaged in a flood.

Whether you live in a flood zone or not, you may believe that your homeowners insurance policy will cover your home after a flood. Unfortunately, this is a myth. Homeowners insurance doesn’t cover damage caused by a flood.

If you believe the myth that homeowners insurance policies cover flood damage, you may find yourself in the situation of needing to make repairs to your home after a flood and not receiving the payout from your policy to cover these expenses. For example, many homeowners assume overland flooding, like water swelling from a nearby river, will be covered by their standard home insurance policy, but this is not the case.

While your home insurance may cover your pipes bursting, it won’t cover water damage from a sewer backup unless you’ve purchased specific coverage.

Homeowners insurance and flood insurance are actually two separate insurance policies, so you must purchase flood insurance separately if you want to be covered. You may also be able to purchase a flood coverage endorsement as an add-on to your existing home insurance policy. Flood insurance can protect your home and personal property after it’s been damaged by water.

If you live in a flood zone, you may have already been required to purchase flood insurance. If you live in an area that isn’t a flood zone but is prone to flooding, you may want to purchase flood coverage. Even if your home isn’t in a flood zone or an area prone to flooding, this type of disaster can happen to anyone and coverage will help protect you if your home is damaged by a flood.

Make sure you also know how the Federal Emergency Management Agency (FEMA) defines a flood so you can understand exactly what your insurance policy covers.

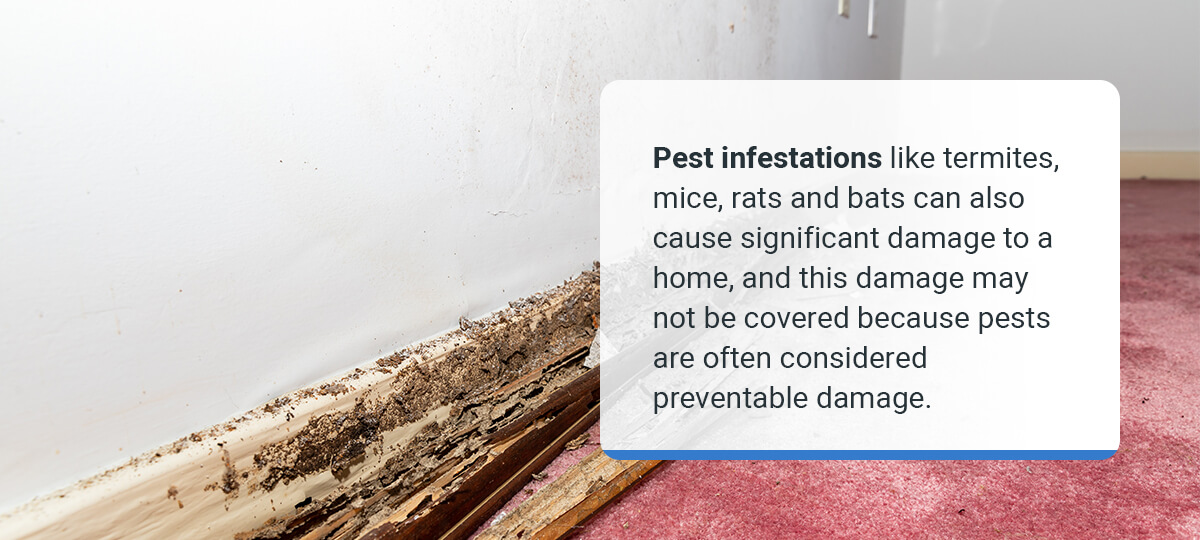

Though your homeowners insurance will cover several types of damage to your home, mold, pests and termites may not be among them.

Because mold usually manifests due to a lack of maintenance, your homeowners insurance policy may not cover the damage. If you fail to properly ventilate a room or prevent chronic water leaks, you’ll probably be on your own when it comes to paying for the damage.

Pest infestations like termites, mice, rats and bats can also cause significant damage to a home, and this damage may not be covered because pests are often considered preventable damage.

Pests and mold can cause serious, expensive damage to a home. If your home insurance provider determines you could’ve prevented this damage, the cost for repairs will likely come out of your own pocket.

Homeowners insurance covers damage from sudden and accidental causes. Preventable causes are typically not covered, or at least not covered entirely. Pest infestations are considered preventable because they tend to occur over time rather than suddenly. Pest infestations fall under the umbrella of maintenance issues, and you as the homeowner are expected to be responsible for the upkeep of your property.

With mold, termites and pests, focus on prevention. You’ll potentially save thousands of dollars by identifying these problems early, resolving them as quickly as possible and avoiding costly repairs.

As a homeowner, you’re expected to keep up with basic home maintenance. When you neglect to do regular maintenance on your home, any damage that results from this lack of maintenance will not be covered by your home insurance policy.

You are expected to reasonably maintain your property, and any damage that occurs from a lack of reasonable maintenance and upkeep will be a cost you pay out of your own pocket.

If you think home insurance will cover damage to your home, regardless of whether you could’ve prevented the damage with routine maintenance, you may find yourself facing a bill that you have to pay out-of-pocket. Without savings, you could end up in a tricky situation.

Home insurance covers certain perils, so review your policy to determine which perils are covered. If your insurance denies your claim, you may need to prove that the damage did not occur as a result of neglected maintenance.

Prevention is key, so stay on top of the maintenance and upkeep needs of your property. Regularly examine your home for mold and pests, and follow a yearly or seasonal maintenance checklist to keep your property in the best possible shape. For example, check the roof regularly and remove debris, inspect the windows, clean out the gutters, seal windows, fix damaged window screens and check for signs of dampness in the basement.

If you, a household member or a guest are injured at your home, you may assume that your homeowners insurance policy will cover the medical expenses. However, bodily injury liability coverage actually pays for only your guests’ medical treatment if they are injured at your property and does not cover treatment for injuries you or your family sustains.

One of the least understood home insurance coverages is bodily injury liability coverage, which likely contributes to the prevalence of this myth and the misunderstandings around this coverage. Under home insurance, in-home injuries sustained by a guest may be covered, along with injuries that a member of your family is liable for. But injuries to you or your family won’t be covered and neither will intentional bad acts, such as intentional property damage or assault.

If you expect your home insurance to protect you if you’re injured in your own home, you may end up in a difficult financial position with medical bills you have to pay for yourself.

The good news is your home insurance’s liability coverage does offer you and your family protection from lawsuits that an injured party files against you. Your insurance may cover legal fees and settlements. For example, if a guest steps on a nail or trips on a loose board on your staircase, they may file a lawsuit against you. Lawsuits are expensive and can quickly become a significant financial burden without insurance, so having coverage will allow you to avoid these legal costs.

Instead of your homeowners insurance, you’ll need to turn to your health insurance if you or your family are injured at home. No matter where you are, your health insurance policy will cover you for an accident and sickness.

If you’re a homeowner, you may assume that the insurable value of your home is based on your home’s market value. Shouldn’t the market value and insurable value of a home be about the same?

In fact, the two values can be very different estimates. Why can the two estimates be so different? While the market value of your home is based on what your property might sell for, the insurable value of your home is an estimate of what it would cost to completely rebuild your property. Completely rebuilding your house is often more expensive than the home’s market price, which means your insurable value may be higher than your market value.

In some cases, the market value may be higher than the insurable value. The insurable value doesn’t include the cost to acquire the property’s land, unlike the market value. Because market value also includes the value of the land, the market value of the property may be higher than the insurable value.

If you aren’t aware that these two values can actually be quite different, you may not be prepared for what to expect if you want to rebuild your home after a disaster.

Rebuilding costs can be high, so you need to have adequate insurance to cover the replacement and reconstruction costs of your home.

Are you worried you don’t have enough insurance coverage for the reconstruction of your home? Insuring up to the purchase price of your home may not be sufficient coverage. When you’re determining how much homeowners insurance you need, you should consider how much construction and labor would cost you if you needed to rebuild your home.

Storms are notorious for knocking down electric wires, telephone poles and trees. When a tree in your yard falls onto your home, you likely expect your own homeowners insurance policy to cover the damage. But what about when your neighbor’s tree falls on your house? Though you may expect your neighbor’s insurance to cover the cost, this isn’t the case.

When a storm hits and your neighbor’s tree falls on your home, you may expect that their insurance will cover the damage to your property. After all, it’s your neighbor’s tree, so shouldn’t it be their responsibility? The reality, however, is that it won’t be your neighbor’s insurance policy covering this peril — it will be your own.

If you lack coverage for this type of peril or you don’t have homeowners insurance at all, this myth could put you in a difficult financial position if you end up in this situation. Now you’ll have to pay for the costs of repairing your home out-of-pocket.

In many cases in which your neighbor’s tree falls on your home, your insurance policy is the one that covers the damage as long as this is covered peril.

Generally, you can only hold your neighbor responsible for the damage if you can provide documentation that they were warned about the tree’s potential danger and refused to resolve the issue. If the tree was clearly damaged or rotting, this may also be a case in which your neighbor’s insurance covers the damage. Proving negligence can be difficult, however, which is why documentation is so vital.

Depending on your state, you may be allowed to trim branches of any tree that falls within your property’s boundary as long as this doesn’t damage the tree and you don’t have to access your neighbor’s property to do so. By trimming the tree, you may be able to prevent damage to your own property.

While home insurance covers many natural disasters, landslides are excluded from a standard homeowners insurance policy.

Since a landslide is out of your control, you may believe the myth that your home insurance policy will cover any damage to your property from a landslide. But the truth is that a landslide is considered a movement of the Earth and explicitly excluded from home insurance coverage.

If you assume your home insurance policy will cover landslide damage, you may be without coverage when you need it. Though landslides don’t happen as frequently as some other natural disasters, if your home is located in a high-risk area, you may want to consider obtaining extra protection, as the cost of the damage from a landslide can be staggering.

Home insurance excludes movements of the Earth from coverage. This includes landslides and mudslides. Insurance companies don’t insure landslides because they are infrequent and tend to cause extensive damage. Even if you have separate flood or earthquake insurance, a landslide won’t be covered.

Instead, you can purchase difference in conditions (DIC) coverage to protect your home against landslides, along with mudslides, floods and earthquakes. Contact your insurance agent about getting a DIC policy. You may need to purchase a separate policy from a different company or an endorsement from your current insurance provider.

One of the most important facts about home insurance is that not all natural disasters are considered equal, and your homeowners insurance policy does not automatically cover you against every natural disaster.

While many natural disasters are covered by home insurance policies, not every disaster is covered. The covered perils also vary by insurer, policy and location. For example, in Missouri, common examples of covered perils under home insurance policies include severe thunderstorms, severe winter weather, tornadoes, fires and hurricanes.

If you assume every natural disaster will automatically be covered by your homeowners insurance policy, you could find yourself without coverage when you need it after a disaster. Two common natural disasters that are rarely covered by homeowners insurance, for example, are floods and earthquakes.

Coverage for natural disasters varies. Some insurance providers may cover up to 15 perils, while others may cover up to only 10. As such, it’s important to review your policy to determine what specific natural disasters are covered or excluded.

After you review your coverage and determine which natural disasters are excluded from your policy, you can purchase additional insurance to solve this gap in coverage. For example, since the standard home insurance policy doesn’t cover flooding, you can purchase a separate flood insurance policy.

For many homeowners, one of the most shocking realities of homeowners insurance is that you may be responsible for a trespasser’s injuries.

Though you may have personal liability insurance to cover you if a guest is injured on your property, you may have to pay out-of-pocket for a trespasser’s injury. Yes, even though they’re trespassing. We tend to think of a trespasser as a nefarious person, but this isn’t always the case. Young children, for example, are common trespassers who are injured on a neighbor’s property.

You likely don’t have to worry about burglars suing you for injuring themselves while breaking into your house, but you do need to worry about someone being injured on your property as a result of an attractive nuisance.

If someone is injured on your property, this could be a concern for you. This myth assumes you’re not responsible for an uninvited person’s injuries because they’re trespassing, and if you find yourself in this situation, you could be held liable.

Attractive nuisances like swimming pools and trampolines could entice trespassers onto your property and potentially put them in danger. If you don’t take precautions to prevent guests and trespassers from being injured as a result of an attractive nuisance, you are putting yourself at risk.

If you have an attractive nuisance on your property, take the proper precautions to prevent anyone on your property from being injured. A gated fence with a lock, for example, could keep curious children from accessing your pool.

When your home is sitting on the market, unoccupied or vacant, you may be responsible for any damages that occur to your property.

Many homeowners assume home insurance will cover damages that occur while you still own the home, even if you’ve moved and the home is still on the market. However, home insurance companies consider unoccupied or vacant homes to be a greater risk and won’t cover a claim.

A home that is unoccupied or vacant is at greater risk of fire, vandalism, burglary, lack of maintenance, theft and liability issues.

As long as your home is unoccupied or vacant for only a brief period of time, such as while you’re on vacation, your home insurance policy will cover a claim you make. However, this isn’t the case if you move and your home stays unoccupied on the market for an extended period.

To solve this gap in coverage, you can either wait to move until you sell the property, or you can purchase a vacant-home insurance policy. Many insurance companies offer this specialty coverage and provide coverage if something happens to your empty home. You may also be able to purchase an add-on to your existing home insurance policy or sign up for an amendment.

While many dog breeds are covered by the standard homeowners insurance policy, a few aggressive breeds are excluded. The large, aggressive dog breeds excluded from many home insurance policies include Dobermans, chow chows, Great Danes, Rottweilers, German shepherds, pit bulls and wolf hybrids.

Few homeowners consider that their dog could impact their home insurance. The reality is that an insurance company can refuse to provide you with coverage depending on the breed of your dog. This is because some dog breeds have a reputation for aggression and are a greater risk to the insurance company.

If you adopt a dog without consulting your homeowners insurance policy, you could end up adopting a breed that your insurance provider will refuse to cover. In this case, you’ll be liable for any injuries or property damage your dog causes.

A homeowners insurance policy’s liability portion typically covers damage and injuries caused by your dog, including bites or property damage.

When the time comes to discuss your insurance needs with your agent, have the details related to your dog ready, including your dog’s history and breed. If your insurance provider refuses to cover your dog breed, you may be able to purchase animal liability insurance or umbrella liability coverage.

As a renter, you may be unsure what your landlord’s homeowners insurance policy covers for you. While the policy may cover the building itself, your personal belongings are another story.

Renters may believe that they are covered by their landlord’s insurance should anything happen to their belongings. The truth is that a landlord’s insurance policy only covers the structure of the building, not your personal property.

If you’re a renter, you may mistakenly believe that you’re entirely covered by your landlord’s insurance. In the event that you face damage or loss to your personal belongings or you face a liability concern, you could find yourself without the coverage you need.

For renters, landlords typically do not carry home insurance for their tenants’ personal belongings. Instead, the landlord’s insurance policy covers only their belongings and liability. The homeowners insurance will cover damage to the physical structure of your rental, which means you are not responsible for insuring the structure. However, you’ll need your own insurance policy to cover your belongings and liability while you’re renting.

To cover your personal belongings as a renter, you should purchase a separate renter’s insurance policy. This coverage will help you replace your damaged, lost or destroyed personal belongings, along with cover your liability if a visitor is injured on the premises. Even if you will be renting for a short period of time, you may want to obtain renter’s insurance. Many landlords even require it as a condition of your lease.

A variety of factors can affect how affordable a home is to insure. If you think you should purchase an older home because it will automatically be cheaper to insure than a newer home, we encourage you to add newer constructions into your home search.

Homeowners tend to assume older homes are more affordable to own, especially regarding insurance. But this isn’t necessarily the case.

Due to different construction techniques, older homes tend to be more costly to repair than newer homes. Old structures like a roof can also increase your maintenance and insurance costs. Worst case scenario, you may end up purchasing a home you don’t love because you think it’ll be more affordable to insure, even if it isn’t.

An older home may have materials like hardwood floors, plaster, crown molding and stained glass. On the other hand, a newer construction home is more likely to have simpler, more affordable construction methods like drywall and wood veneer floors.

Rather than focus your search only on older homes to save on home insurance, keep in mind that a newer home may actually be more affordable to insure. Consider what materials the home is made of and the condition of the structure, as these may be greater indicators of how affordable your home insurance rate will be.

Though it’s true that your claim history can affect the calculation of your home insurance premium, filing a single claim does not necessarily increase your rate.

This is a common myth for both homeowners insurance and auto insurance. Likely, this myth continues to spread because your claims history does factor into the offered rate. However, your monthly payments are unlikely to be affected by one claim.

If you avoid making a claim because you’re fearful of your rate increasing, you may lose more money by covering the damage yourself. You may also not currently have the savings to cover the costs.

One claim isn’t necessarily going to impact your insurance rate. Filing multiple claims within a short timeframe, however, could cause your premium to go up. If you believe you have multiple claims to file, be selective about which ones you do file with your insurance provider and cover the smaller claims yourself.

To determine whether you should file a claim, review your deductible and compare this amount to your repair costs. If the costs for repairing the damage are about the same or less than your deductible, you may not want to file a claim. If the costs exceed your deductible, especially if the expense would be significant, you may want to file a claim.

Legally, you are not required to have homeowners insurance to own a home.

Since so many homeowners carry home insurance, you may believe the myth that this coverage is required by law. However, this actually isn’t true, and you won’t get in any legal trouble if you forgo home insurance.

Though you may not be legally required to purchase home insurance, many mortgage lenders do require you to obtain home insurance and will require proof of coverage before they’ll sign off on your mortgage loan. If you forgo coverage, you may not be able to secure a loan, or you may be putting yourself at great financial risk.

Since your lender is taking on a financial risk by lending you the money to purchase your home, they want to know that their investment is protected from covered perils and disasters like fire and wind. Having insurance also protects your personal belongings in the event of a disaster.

Even if your lender doesn’t require homeowners insurance or you’ve paid off your mortgage, you can protect yourself and your home by continuing to carry a home insurance policy. If your house is burglarized or damaged, home insurance will ensure you don’t have to cover the out-of-pocket costs or jeopardize your financial future.

The rule of thumb is that you should shop around for insurance periodically to determine whether you can get a better deal from another insurance provider, including home insurance.

For many homeowners, the monthly home insurance premium is included in your mortgage payment. This can result in a set it and forget mentality. You may even believe that there aren’t any benefits to shopping around for a different insurance policy.

Though some insurance companies offer discounts to customers for renewing their policy and sticking with the company for years, you may actually be missing out on a better deal by not shopping around each year. This could lead to you overpaying for home insurance unnecessarily.

You can shop around and switch home insurance providers as often as you want. By shopping around, you can enjoy significant annual savings. You also don’t have to wait for your policy’s end date to change insurers. Though some providers may charge a small fee if you cancel your policy early, many will allow you to cancel free of charge.

If your premium has increased significantly at renewal, you may want to shop around to find a lower rate elsewhere. Even if your rate hasn’t increased by much, shopping around can ensure you’re getting the best deal possible.

Reducing your coverage may put you in a risky financial position. Fortunately, there are a few ways you can reduce your insurance premium without lowering your coverage.

Many homeowners think the best way — and maybe the only way — to lower their home insurance premium is by reducing coverage. If you’ve been considering cutting some of your coverage to say on your monthly insurance cost, we’re happy to debunk this myth so you can keep your home protected.

Having adequate coverage for your home is essential, and lowering your coverage because you think it’ll reduce your premium can leave you without the protection you need. If you lack coverage when you need it, you could be in a far worse financial position than you would be with a slightly higher premium.

The whole point of having home insurance is getting the coverage you need to protect you, your family and your home. Your house is likely your most valuable asset and one of your greatest investments, so it’s crucial to protect it.

You can lower your premium using a few other tactics. Consult with your insurance provider to determine what discounts they offer. Examples include installing a home security system and opting for a higher deductible.

Even if not required by law, homeowners insurance is well worth the cost. Your home is likely your most valuable asset, and obtaining insurance is a great way to protect your financial investment.

Many homeowners are concerned that home insurance will be too expensive and not worth the investment. The truth, however, is that home insurance is affordable and can provide you with substantial savings should a disaster occur.

This is perhaps the worst home insurance myth, especially if it leads you to forgo this essential coverage. Without home insurance, you’ll be assuming a huge financial risk, and if damage or theft does occur, you’ll need to pay for the costs out of pocket. After a fire, for example, the cost could run you tens of thousands of dollars between repairing the damage, replacing your belongings and paying for a hotel stay. Additionally, if someone gets hurt while on your property, you could face a significant financial loss if you’re found legally responsible.

Whether you’re facing a disaster or a personal liability case, you could find yourself in deep financial trouble without coverage and significant savings.

The average monthly cost of home insurance is actually fairly low and affordable. Home insurance can be the difference between replacing your personal belongings or rebuilding your home after disaster strikes and losing all your belongings or even being forced to move. If you have a personal liability lawsuit, homeowners insurance may protect your assets.

Though the cost is already affordable for many homeowners, you may be able to lower your rate even further. By shopping around, choosing lower coverage limits and opting for a higher deductible, you may be able to secure a more affordable insurance rate. Insurance providers often provide discounts that help you lower your premium as well. Discounts you may qualify for include owning a newer home, living in a gated community, being a nonsmoker and having no history of recent claims.

One last insurance myth is that you don’t need an insurance agent. However, an insurance agent can serve as a guide through the navigation of insurance policy options. An insurance agent can work with you to learn your specific insurance needs and find you the most favorable terms to provide you with the best insurance solution.

At David Pope Insurance, we can offer you financial stability by helping you get the lowest home insurance rate on the market. We’re a local, family-owned firm with more than two decades of experience in providing Missouri residents with the insurance coverage they need, including home insurance, auto insurance, life insurance and commercial insurance. We know how precious your time is, which is why we finish quotes and answer questions the same day you submit them.

We can help you obtain high-quality home insurance that gives you the peace of mind you need for a low cost, regardless of whether you’re a first-time homeowner or you’re buying a high-value home. Contact us at David Pope Insurance for more about home insurance FAQs or to speak with an insurance agent who can help you find the right insurance solution.