A recreational vehicle (RV) allows you to bring the comforts of home along whenever you travel, whether that’s just once a year for a week-long excursion or when taking regular trips out to your favorite campsite. Some full-time RVers even use their motorhome as a permanent residence.

Since an RV can be more than just a vehicle, RV owners may use their motorhome for either part- or full-time travel. Insurance coverages for motorhomes and RVs can vary widely between different RV users. If you’re looking for recreational vehicle insurance, there are several important questions you’ll need to consider to obtain the most appropriate coverage for an affordable price.

If you’ve recently purchased or are considering buying an RV, you may be wondering if you need RV insurance. All states require RVs to have the same minimum liability coverage as any other vehicle driving on the road. Like auto insurance, most states require RV insurance for bodily injury and property damage liability. Whether the liability extends from a towing vehicle or must be purchased separately depends on the type of RV.

RV insurance varies widely. In addition to the RV type, it is essential to consider your lifestyle and personal preference for protecting this valuable investment. With the right recreational vehicle insurance, you can get coverage for more than just the required minimum liability.

RVs are used for many purposes. How you plan to use your RV will be one of the first factors an insurer considers when categorizing you as a part- or full-time RV user. Whether you’re regarded as a part-timer or full-timer helps determine the coverage options that will apply. This distinction is essential because an RV owner who spends most of the calendar year traveling the United States in their motorhome will be at higher risk for collision and other liability incidents.

Do you plan to use your RV intermittently as a vacation vehicle? Will it become your permanent residence? The number of days spent in your RV each year could cause insurance companies to sort you into a particular category based on your liability needs. Part-timers only use their RV occasionally, so they tend to have less collision risk and lower insurance rates. The more liability, the higher your RV insurance rates are likely to be.

What an insurer considers “full-time use” can vary between different insurance companies. The commonly accepted definition of a full-time RVer is someone who spends more than 150 days in their RV each year. Insurance companies may even set further distinctions between different types of full-time RVers based on precisely how much time they’ll spend on the road in their RV.

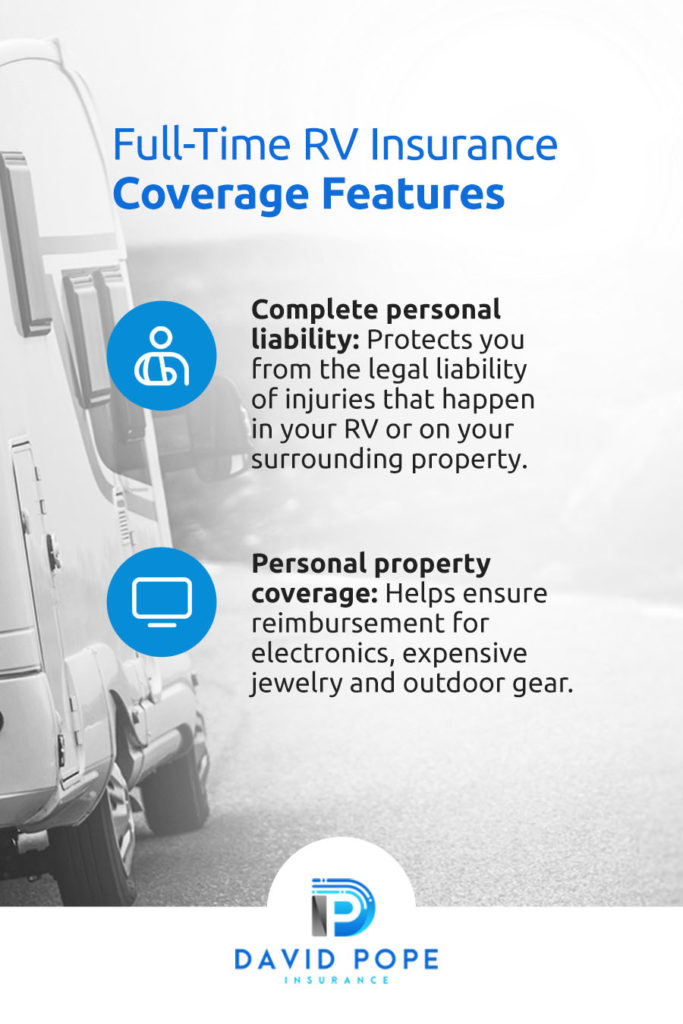

Owners who use their RV as their primary residence, spending closer to 365 nights per year inside their motorhome, generally have more liability than a full-time RVer with a permanent address that they can return to periodically. If you live in your RV year-round, you’ll want to look into a type of coverage known as full-timer’s RV insurance. In addition to the mandatory liability coverage for the RV, full-timers will want to ensure their policy includes personal liability and personal property coverage.

The items covered by RV insurance entirely depend on your specific policy. Generally, RV insurance services offer many coverage options — from the amount of liability you can carry to the level of protection given to personal effects kept inside the motorhome. Someone using their RV for cross-country road trips may require different coverage options than someone using an RV as a primary residence. That’s why it’s crucial to purchase the right policy for your type of RV, lifestyle and personal preferences.

Each policy can include several types of RV insurance coverages. Most insurance companies provide standard RV coverage features, representing the foundation of any RV insurance policy, whether you’re a part-timer or full-timer. However, it is important to ensure your policy has all the essential and additional coverage features you require.

Some basic coverages that are essential for RVs and motorhomes include:

Additional coverage options for RVs and motorhomes include:

Full-time RV users will want RV insurance coverage that more resembles what would be carried in a homeowner’s insurance policy, especially if their RV is their permanent residence. While a homeowner’s policy might cover personal belongings, even if they go missing from your car or RV, you must verify coverage for long-distance and long-term travel across state lines.

In addition to the basic RV insurance coverages mentioned above, a full-timer should ensure their policy includes the following features:

Additionally, a full-timer may include roadside assistance, emergency expense coverage and other specialized insurance options to protect their valuable investment.

Part-time RV users will want RV insurance that is only used during part of the year. Protect your RV inside and out when you’re using it, without paying for unneeded coverages when you aren’t. This includes general liability protection for bodily injures and property damage caused to others. However, specialized RV insurance coverage features may also apply.

While most full-timers have year-round personal liability coverage, many part-time RV users choose vacation liability instead. Vacation liability coverage achieves a similar amount of protection, but only for part of the year. Your insurer will determine an exact coverage time frame, meaning you will have to plan your trips before the allotted cut-off. If you want the freedom to take spontaneous vacations without these constrictions, you may need to purchase complete liability coverage despite being considered a part-timer.

Recreational vehicles that don’t require year-round coverage can benefit from temporary RV insurance features. Some insurance companies offer a storage option, allowing you to suspend some coverages while keeping the protections that matter all year. For example, collision coverage is only necessary when driving your RV on the roads. Meanwhile, comprehensive coverage can help protect an RV from vandalism, theft, extreme weather and fire even while it’s stored away.

Regardless of how much you use your RV, emergency expense coverage for loss of use is also worth your consideration. You may find yourself in a situation where you need somewhere to stay after your RV is disabled in an accident. Emergency expense coverage helps you pay for temporary housing, transportation and other unplanned expenses while you make your trip back to your primary residence.

All states in the U.S. that require auto insurance also require you to have the same minimum liability insurance for any RVs and motorhomes driven on public roads. Whether operating a car or a drivable RV, all drivers in these states must at least have liability coverage for bodily injuries and property damage they cause with their vehicle. While this type of RV insurance is mandatory for all RVs you can drive on the road, getting coverage for a tow-behind camper may be optional.

If your RV must be hooked up to a car or truck, it poses different insurance requirements than an RV with its own motor. In many cases, the liability coverage from your regular auto policy will extend to your towable trailer as long as you list it on your declarations page. Even though you may not require liability insurance for your travel trailer, you will often need to purchase collision and comprehensive coverage separately for both the tow-behind camper and the vehicle used to tow it.

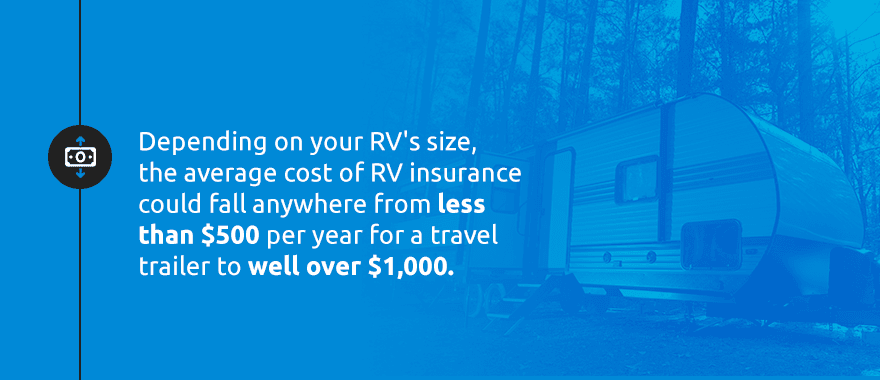

RVs come in all shapes and sizes — from luxury Class A motorhomes to conventional travel trailers to retro pop-up campers — so the type of RV insurance you need and its average cost will vary widely. Depending on your RV’s size, the average cost of RV insurance could fall anywhere from less than $500 per year for a travel trailer to well over $1,000 for a Class A, B or C motorhome. There will also be significant variation in price between each motorhome class:

Your RV insurance rate will also depend on state laws, as insurance costs differ from state to state with the various requirements for insurance type and amount of coverage. Some other primary factors that can affect your RV insurance rates include:

There is no definite answer for someone wondering how much it costs to insure an RV. Depending on the type of RV you own and your lifestyle, your insurance costs could differ significantly from other RV owners. RV insurance should be customizable, but you can avoid overspending on insurance by considering how the above factors may influence your overall price.

To reduce how much your RV insurance will cost, we recommend comparing different discounts from various insurance companies. Some insurers offer special discounts to RV owners that may help you save on insurance, such as:

When looking for the best RV insurance company, it is essential to evaluate each provider’s coverage options, costs, customer service and available discounts. If a business offers the best price but cannot include all the coverage features you require in a policy, it may not be the best RV insurance company for you.

Consider working with an experienced company, like David Pope Insurance Services, LLC, that can compare rates from multiple insurance providers to help you find the right policy for your needs. You will get a personalized quote, including information on all available discounts and answers to any questions you may have about the different rates.

At David Pope Insurance, we get you the lowest RV insurance rates on the market to help you secure a policy that includes all the coverage options you require. Compare rates from multiple insurance companies to find high-quality insurance at a reasonable price. For over 15 years, we’ve been providing peace of mind to Missouri motorhome owners with fast and reliable RV insurance quotes. Start on your custom quote today with David Pope Insurance.