With homeowners insurance, you may have coverage for certain perils, such as wind, lightning and hail. However, damage due to other causes, like earthquakes and floods, may not be covered. This means water damage is sometimes covered by homeowners insurance and sometimes isn’t. Homeowners insurance may cover basement floods if it’s from a mishap like a burst pipe. But damage from large floods isn’t included, so a flood policy is best protection. At David Pope Insurance Services, LLC, we’ve compiled this guide to help you understand whether your policy will cover water damage and how to navigate water damage claims.

Jump To:

With the exception of fire, nothing is more destructive to homes than water damage. Water damage is one of the most commonly reported homeowners insurance claims, as well as one of the most costly. In 2020, water damage and freezing accounted for nearly 20% of all homeowners insurance losses, costing an average of $11,650 per claim. Without homeowners insurance, repair costs would be coming out of your pocket.

Luckily, homeowners insurance covers water damage in various scenarios. Under the standard homeowners insurance policy, water damage must be internal and sudden to be covered. Your policy may also note another requirement that the water hasn’t touched the ground outside.

Water damage can cause significant issues that may require the replacement of destroyed property, repairs to part of your home’s structure and even relocation for a few days. The standard home insurance policy has three clauses that may provide coverage if your home sustains water damage:

Request a Free Homeowners Insurance Quote

Water damage to your home may be covered if it stems from one of the following causes:

Homeowners insurance often covers water damage from rain, in addition to:

Water from a thunderstorm in the summer or snow in the winter can damage a home. In a state with frigid winters, you may deal with lengthy blizzards and heavy snowfall. If temperatures drop below zero, ice may form on your house. After a heavy snowfall, tree limbs could collapse under the weight of the snow. This could all lead to damage to your home.

Though damage from hail and ice is usually covered under a home insurance policy up to the policy’s limits, coverage varies for water damage depending on the cause.

Plumbing problems are a common type of water damage covered by homeowners insurance. Any unexpected and sudden water damage caused by a broken pipe, a plumbing malfunction or a leaking pipe in the wall may be covered by homeowners insurance. For example, you may be covered if water starts unexpectedly pouring from your washing machine when you aren’t home. In this situation, your floorboards could buckle, and water could damage the ceiling or walls of the floor below if it leaks through the floor.

Your home insurance policy may exclude damage that occurred gradually or from normal wear and tear, like a slow, constant leak or regional flooding. You also likely won’t be reimbursed for damage that results from a backed-up drain unless you purchase an endorsement.

When you submit a claim for water damage due to plumbing problems, an insurance adjuster will be sent to assess the cause and cost of the water damage. The adjuster will evaluate the following:

Your insurance adjuster will determine whether you could have reasonably prevented this water damage from occurring. You may be denied coverage if the adjuster determines you could have detected and prevented the leak.

If you have a leaky roof, you may be wondering if home insurance covers leaks and if you can get coverage for the repairs or a new roof. Fortunately, roof leaks tend to be covered by homeowners insurance policies in most cases. However, it’s ultimately the roof leak’s cause that determines whether your policy will cover the damage. The cost of repairing or replacing your roof may be only partly covered.

Your home insurance policy may either list the perils it covers or list only the perils that are excluded. Most of the perils that could cause roof damage are covered under your home insurance policy, such as falling branches, snow weight, wind and hail. Common perils of roof damage that your policy may not cover include:

If your roof leak is caused by any of these, your claim may not be covered. From the perspective of insurance companies, these are considered maintenance issues that you are responsible for repairing. Roofs are typically covered for actual cash value rather than replacement cost. Actual cash value is a depreciated value that is based on wear and tear caused by age.

Does homeowners insurance cover bathtub overflow? What about washing machine overflow? You may have coverage in the case of an overflow. However, this could vary depending on what your insurance company determines to be the exact cause of the problem. Did accidental, sudden damage cause the overflow? Did you properly maintain the washing machine?

Typically, home insurance covers water damage that results from a broken appliance. The keyword in this instance is “accidental.” If the overflow was accidental and sudden, you will likely have coverage, as the damage wasn’t a result of negligence. Overflow from a body of water like a river or lake that causes a flash flood in your home is not likely to be covered. This is considered flood damage, which is not usually covered under homeowners insurance.

While mold can commonly cause damage to your home, it isn’t always covered by home insurance. Ridding your home of a mold infestation can be expensive, so it can be beneficial if your homeowners insurance policy covers part of the removal cost. Whether mold will be covered under your policy depends on what caused the mold.

If mold is caused by a covered water damage peril, the damage is likely to be covered under your home insurance policy. If a situation like an accidental overflow or a burst pipe led to mold growth, your policy may cover part or all of the removal cost. In this case, the damage from the mold is covered as it’s considered a result of water damage. If the mold damage is a result of neglect or lack of maintenance, you may not get coverage.

If you decide to file a claim for mold damage with your insurer, the cause of the damage will be determined by an adjuster. To ensure you have mold coverage, you may want to consider purchasing an endorsement or floater. You can also try to prevent mold growth by addressing leaks and spills as soon as possible and keeping your home dry. Consider the following mold prevention tips:

Fires can cause a devastating amount of damage to a home. Common causes of fires in homes include:

Beyond the damage a fire can cause, efforts to extinguish a fire can also lead to the development of mold in the walls or leave your home’s structure exposed to the weather. Wet drywall often leads to mold, which means the drywall and underlying wood on the exterior and interior of your home should be inspected and properly repaired.

Not Sure if You’re Covered? Contact Us

An inspection of your home following fire suppression efforts should include your roof, siding, windows, concrete, heating systems, plumbing systems, interior walls, iron structures and steel structures. The wood under your roofing material, for example, may become water stained and moldy. An expert will be able to identify and verify this damage so you can address it.

If extinguishing a fire led to water damage to your home, you may want to consider filing a claim with your insurance provider.

Request a Free Homeowners Insurance Quote

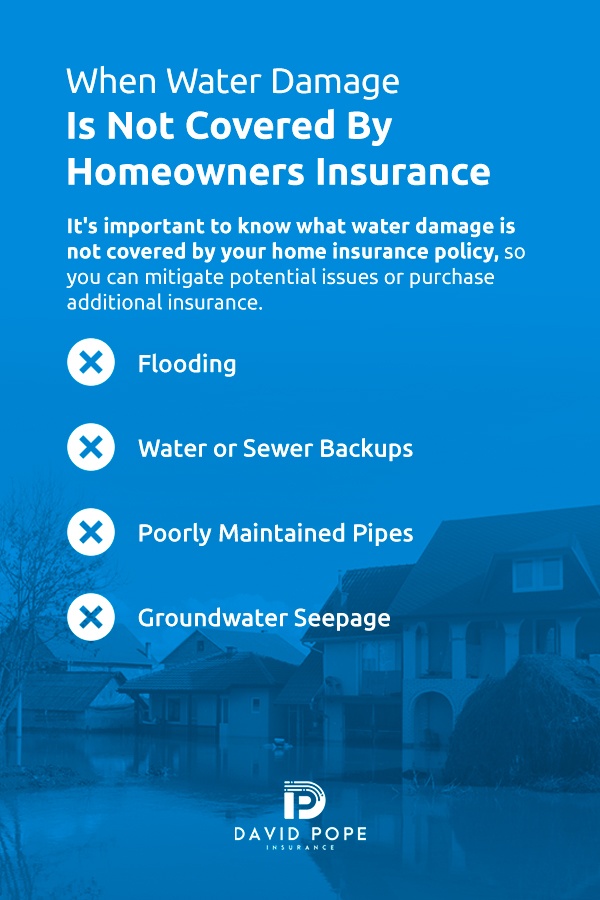

It’s important to know what water damage is not covered by your home insurance policy, so you can mitigate potential issues or purchase additional insurance. The types of water damage not covered by homeowners insurance include the following:

Many homeowners falsely believe that home insurance will cover flood damage. The truth is that flood damage is not always covered by home insurance. Those who live near a body of water or in areas of extreme weather are particularly at risk for flood damage. A flood can sometimes develop slowly and give homeowners some time to react, but other times, the flood can come suddenly. The following are different kinds of floods you could experience:

Floods often result from hurricanes and heavy rainfall. On top of the flooding, high winds can accompany hurricanes and lead to additional damage, potentially triggering landslides and mudslides. Just a few inches of floodwater inside your home can quickly become an expensive problem. For coverage in the event of a flood, you may want to purchase a separate flood insurance policy. This is especially important if your home is located in a flood zone.

Home insurance also typically doesn’t cover damage from water or sewer backups. This damage tends to occur when a pump fails or a sewer, gutter or drain backs up and forces water into your property. For example, this may be a drain backup after heavy rain or from debris that causes a clog.

Water damage caused by a failed pump or a backed-up drain is one of the most common claims from homeowners. Behind fire and liability claims, water damage is also one of the most costly claims.

If you want coverage for a failed sump pump, backed-up drain or clogged sewer line, you may want to purchase water backup and sump pump overflow coverage. This coverage is optional and can be added to your homeowners insurance policy if you choose to purchase it. This insurance may also cover mold damage to your home that resulted from a water or sewer backup.

Homeowners insurance is unlikely to cover damage from leaking pipes if it is determined there was a degree of negligence on your part that led to the pipe break. If pipes break as a result of wear and tear or because you have not been properly maintaining them, the chances of approval for your claim may be diminished. Essentially, pipe degradation is far less likely to be covered than non-negligent, accidental damage.

When your claim is assessed by a claims adjuster, they will evaluate the following:

The claims adjuster will determine whether the damage could have been prevented had the pipes been properly maintained.

In addition to pipe condition, your claim may be affected by the location of the damage. Pipe breaks that occur directly under the home’s foundation may be covered, but if the break is beyond the foundation, it may not be. Additionally, you may have a difficult time proving the pipe is on your property if the damage is from a pipe that is connected to the municipal system.

To ensure a pipe break is covered under your home insurance policy, keep your pipes regularly maintained. You may also want to review your home insurance policy and consult your insurance agent to understand what is and isn’t covered.

Another source of water damage that may not be covered by homeowners insurance is ground seepage. This occurs when water flows from place to place via a porous material or small hole, which tends to occur after heavy rain. This leads to groundwater levels rising, and the additional water creates pressure against the foundation of your home. Under this pressure, water could be forced into your home, even through small cracks in your basement’s walls or floor. For coverage against water seepage, you may be able to add on coverage to your policy.

Homeowners insurance typically won’t cover the cost to replace or repair the source of your water damage. For example, if your washing machine or dishwasher malfunctions and causes water damage, you’ll likely have to cover the appliance repairs out of pocket. Source repair and replacement typically aren’t covered because they qualify as maintenance issues, much like repairing pipes.

When the unexpected arises, it’s best to act fast to help limit the potential damage. As with any property damage, the longer you wait to tackle the problem, the worse the damage gets. Knowing what to do in these situations allows you to prepare a plan and be ready to handle water damage promptly. Here are four steps to take right away:

Above all else, do whatever is necessary to keep you and your family safe. If necessary, evacuate the area until it’s safe to return. Water damage can be extremely dangerous, especially when it comes to mold growth and contaminated water.

If you’re able to, shut off your electricity. Water and electricity are a dangerous combination, so never reenter a flooded home before you’re certain the power is disconnected. Once you can reenter your home or navigate the damaged area, wear protective clothing like rubber boots and gloves. Doing so will help prevent you from directly contacting bacteria-filled water. If you can do so safely, remove any valuable possessions and documents from the property.

Be sure to document the damage with photos and contact your insurance company as soon as possible after the damage occurs. Be sure to document any clean-up you do and keep detailed records of receipts so you can seek reimbursement. Thorough documentation will also be helpful for the claim’s adjuster when they assess the damage and your coverage.

If you’re going to handle the drying and restoration yourself, begin immediately. Getting your house dried out is crucial to preventing further damage and limiting mold growth. Remove wet furniture, hang rugs to dry and utilize fans and dehumidifiers, renting professional-grade equipment as necessary. The sooner you get everything dried out, the safer you’ll be.

Begin assessing what’s salvageable and dispose of damaged items. Depending on the extent of the damage, you may need help from a professional to handle damage restoration properly and safely. For example, moisture can get trapped in drywall, insulation and flooring, which may require more work than you can do on your own.

Do you believe you may have a water damage claim? If so, you may want to know how to file and maximize your claim. Consider the tips below when filing a claim due to water damage:

When you discover water damage in your home, take steps to control the damage as much as possible. If you don’t make any attempts to control the damage, your insurance provider may not approve your water damage claim.

The steps you’ll take depend on the type of water damage you’re dealing with. For example, if a window is broken during a windstorm and lets water in, you may want to board up the window. If the water damage is caused by a plumbing leak, you may want to turn off the water. If you are dealing with a roof leak, you can lay a tarp down to temporarily block the rain.

After taking these initial steps to control the damage, reach out to professionals who can provide the services you need as soon as possible, such as roofers, plumbers and restoration specialists.

Your insurance provider may require that you present evidence with your water damage claim. Luckily, documenting evidence is quite easy if you have a smartphone. Take pictures and videos of anything you think could have caused the water damage. While recording the videos of the damage, talk about what you’re seeing.

Along with picture and video evidence, you may want to create written evidence. Write a list of what was damaged and include the value and projected replacement cost of each item. If you are unsure about how some of these items should be priced, you can consult a restoration expert.

Finally, contact your home insurance provider. If you delay reporting the damage, this could negatively impact your claim, so be sure to report the damage to your insurer as soon as possible. Even if you plan on repairing the damage yourself, letting your insurance company know can spare you a headache later on. Try to make a claim even if you’re not sure the damage is covered by your home insurance policy.

While flooding and storms are out of our control, there are many things you can do to protect your home and better prepare for water damage situations. Here are some routine maintenance and preventive measures you can take to protect your home from water damage:

When you want to protect your home, look no further than David Pope Insurance Services, LLC for the insurance policies you need. We offer home insurance, auto insurance, life insurance and commercial insurance to residents throughout the state of Missouri. We strive to find the lowest rates available on the market, giving you the peace of mind you need when it comes to your financial security.

Our agents are committed to providing quality service to each of our clients. Within the same day, we answer questions and finish quotes. You can trust us to customize your homeowners insurance to meet your coverage needs. If you’re a new homebuyer looking for home insurance, contact us at David Pope Insurance to learn more or request a free quote today.

Other Homeowner’s Resources: