The point of insurance is to cover you in the event of damage, loss and liability. If an insurance policy leaves you saddled with unreasonable premiums, high deductibles and little actual coverage due to vaguely worded exceptions in the fine print, chances are you didn’t get the coverage you thought you were getting when you signed the policy. If you find yourself in this situation, you can get a free quote from us to determine if you are being taken advantage of.

Certain home and car insurance policies can fall short of your expectations or be unnecessary. Here are the top five types of insurance policies to look at closely:

Before you sign an auto insurance policy, consider the value of your vehicle compared to the coverage. With an old or used car or truck, the cost of major engine repairs could exceed what you paid for the vehicle itself. As such, basic liability coverage is all that you would need. A comprehensive policy would be excessive and cost you much more than necessary for such a vehicle.

Most insurance applicants assume that a policy will cover a vast range of accidental damages. Under some policies, however, damage coverage is limited to defined events. Unless the policy specifically defines a damage-causing event, no coverage will be rewarded to the claimant. Avoid policies in which the defined events are limited, improbable or irrelevant to your situation.

Most homeowners insurance policies include an exceptions clause for unoccupied properties. If you have a secondary beach house that is empty or that you sublet for several months out of the year, make sure you have a homeowners policy that will cover the cost of property damage incurred during those months.

If you run a business from your home office, expenses related to that business won’t be covered under the policy. For example, non-household items such as copy machines might not be covered under certain homeowners plans. If you run an office or worksite on your own personal property, you will likely need separate commercial insurance to complement your homeowners policy.

Some policies will include specific provisions that might not apply at all to your situation. These excess provisions will cause the premiums to be higher than necessary. If the policy is otherwise what you need, the insurance company should allow you to opt out of the parts that you don’t need. If not, look for a better policy elsewhere.

There isn’t a short answer for which insurance coverage you should invest in and which to avoid. You can get by with the minimum coverage required — something that varies by state for auto insurance — but then you may find yourself in a tricky situation where insurance could have helped.

Instead of defaulting to purchasing some policies and not others, you’ll have to look at your specific situation, location and more to decipher what you deem necessary. Let’s look at the following examples to discover the types of insurance to avoid:

Collision insurance helps pay for your car repairs if you get into an accident. Comprehensive insurance covers damage to your car that results from reasons other than a crash, such as weather- or theft-related damage.

Currently, no state requires collision or comprehensive coverage, though you may need to have them if you finance or lease a vehicle. When deciding whether or not to maintain your collision and comprehensive coverage, you’ll need to calculate the current market value of your vehicle.

The current market value is the maximum amount your insurance will cover if you experience a covered event that damages your vehicle. Depending on how much your vehicle is worth will help you decide whether or not you need collision and comprehensive auto insurance. For example, if your car is worth $1,000 and you get into an accident where you need $6,000 to fix the damages, your insurer will only provide you with $1,000 minus the deductible. In this instance, you might decide collision and comprehensive is not necessary.

Mortgage life insurance pays off your home in the wake of your death. However, getting a term-life policy makes more sense than adding an entirely new homeowners insurance policy. Your life insurance plan should be able to cover any mortgage payments left on your home.

Some insurance policies help cover the cost of a rental car if you get into an accident and your vehicle needs extensive repairs. However, many car rental prices are relatively inexpensive and many people don’t find themselves renting cars often. With this in mind, you might not need rental car insurance.

On the other hand, car rental damage insurance can help cover rental accident costs. Many auto insurance policies already cover car rental damages, so read your policy closely before purchasing an additional policy. You may also be able to pay for car rental insurance out of pocket when you pick up your rental car. If you can save money by paying out of pocket, it might be the better route, especially if you don’t rent vehicles often.

Like rental car and car rental damage insurance, auto insurance add-ons can include more specific coverage that fits your unique needs. Other examples include gap coverage and custom equipment coverage. While these policies may fit your particular needs, they can add up quickly, so you should be careful when selecting what to add.

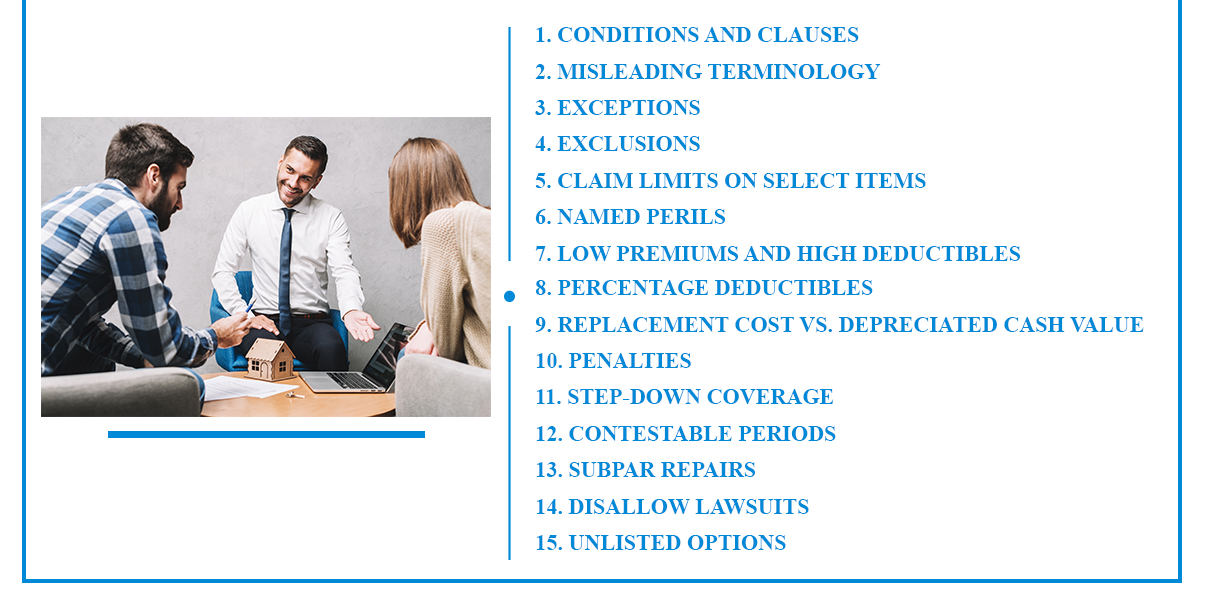

It’s an unfortunate truth that some insurance companies are only in the business for the money, and these agencies may try to get you to sign a policy that’s not in your best interest. Thousands of policyholders have paid into plans with no return in the end. Here are some of the things you can look out for when considering an insurance policy or provider:

Under some insurance policies, your claim might be denied due to certain conditions that weren’t clearly outlined when you signed the policy. If your house incurs damages while you and your family are away for vacation, coverage could be denied or drastically reduced under a vaguely worded “uninhabited” clause. This clause might stipulate that the policyholder must be present at the time of damage to file a claim.

Insurance policies are written out in legal terminology that can be difficult for the average person to understand in full detail. Moreover, many policies contain vague terms that could easily mislead applicants. You might sign onto a policy thinking that you will be covered if your house or car gets damaged, only to discover later that the coverage is limited to specific forms of damage.

A lot of low-cost insurance policies don’t provide the coverage that applicants might expect at the time of signing. You might think that your homeowners insurance will cover a vast range of damages, yet find later on that the damage in question must originate from a specific set of factors. The same could hold true with an auto insurance policy that supposedly covers the value of your vehicle, but only if the damage occurs while driving.

Some insurance companies advertise policies that promise coverage for a general range of categories. In the fine print, however, numerous exclusions are listed either directly or vaguely. For example, renters insurance might ostensibly cover “personal property,” yet the fine print excludes high-value items.

Similarly, some policies will cover a general amount of loss or damage but restrict the amount of coverage rewarded in specific claims categories. If a thief steals rare, valuable jewelry from an apartment, the tenant’s insurance policy might cap the amount they will reward for jewelry alone. Such policies are designed to offer coverage that is generous in theory but restrictive in practice.

Just because an insurance policy provides “disaster relief” doesn’t mean your insurer will accept a claim over any disaster. An insurance advertisement might imply that you will be covered for loss or damage in the general sense. Yet, the coverage in question will only apply to items or causes listed specifically in the fine print. You might be covered if your house catches fire from a malfunctioning furnace, but not from a stray spark from a neighbor’s fire pit.

Some insurance policies are offered at extremely low introductory rates with ongoing low premiums for the length of the policy. If you need to file a claim, however, you might be required to pay a high deductible before the coverage can be rewarded. This explains the low premiums, which in turn means the insurance company rewards few claims.

A deductible might not seem too steep or burdensome until you need to file a claim. For example, if your homeowners insurance has a coverage limit at $500,000 with a low $1,000 all peril deductible, but then you see off to the side that you have a 2% wind/hail deductible, then that means for the claim that you are most likely to have — wind or hail damage to your roof — would have a $10,000 deductible. To make matters worse, because your policy most likely has an inflation guard, your deductible would increase 5% each year.

If an item in your house is lost in a fire or stolen in a burglary, you might not be compensated for its full value. Under certain home and apartment insurance policies, an item is covered for its current value, not its original price or the cost of getting a replacement. If you purchased your computer four years ago, it would have depreciated as both a used computer and an older, possibly outdated model. Therefore, the policy won’t cover the replacement of said model and certainly won’t afford you a newer, higher-priced model.

Some of the seemingly best deals on insurance coverage come with high penalties that many applicants don’t understand when they sign the policy. An insurance company might impose steep cancellation fees to compensate for the low introductory rates offered to first-time applicants. Alternately, the premiums may increase drastically after the first 12 months. If the premiums do stay low, you might find the policy doesn’t cover much at all.

Damage under negligent circumstances could understandably disqualify your claim. With some policies, you might be rewarded a reduced amount in specific situations. For example, if an accident occurs while someone else drives your vehicle, you might only get a small percentage of the repair costs that would have been covered by your policy if you were driving.

This can prove unfair if the exceptions are vaguely worded or drastically cut rewards in the vast majority of potential claims. What’s worse is some step-down coverage drops you down to state minimums automatically. If you’re in a bad accident, you could end up owing so much out of pocket that you lose your house.

Under some insurance policies, the insurer has an escape clause that is only in the fine print. A contestable period is a time frame where the insurance company can cancel a policy in light of new information. With certain types of life insurance, your coverage could be terminated within the first 12 months if you discover and report a life-threatening ailment.

If you get auto insurance at a low rate, there might be a catch when you visit a repair shop. Some auto insurers will only pay for aftermarket replacement parts, which might be inferior, especially if the vehicle in question is a new, recently purchased model. Many applicants often miss stipulations such as these hidden in the fine print.

Some insurance companies institute policies to prohibit lawsuits from policyholders. This could put you at a disadvantage if the insurer downplays your claim and refuses to grant rewards in the amount that the letter of your policy entitles you. Ethical insurers, on the other hand, don’t fear legal recourse because they operate within the law and will happily settle disputes.

Some insurance companies advertise certain options in a way that infers they include those options in a general policy. However, those options are only offered as extras at higher premiums. Alternately, the options are vaguely worded or more restrictive than they seem. In general, if an item or loss-category is not specifically listed, it won’t be covered unless you have it added before you sign the paperwork.

In review:

To ensure that you don’t get misled by an unscrupulous insurance company, gather as much information about insurance options in your area, and read all the paperwork involved with a given policy before you sign.

Before you sign any insurance policy, it is crucial to read the fine print. If you don’t, you might be signing away large amounts of money for little reward if you ever need to file a claim. Send your agent an email with all your questions to ensure you understand the wording of the policy and to have written documentation of what the agent said was covered.

When you sit down to speak with an insurance agent, raise every question that comes to mind regarding the policy options at hand. Make sure that all points are clarified before you agree to any one policy. Only with clarity can you come away a secure and protected policyholder.

Before you seriously consider signing with an insurance company, look up that company’s name on the DOI website. Here, you should be able to determine if the company in question is legitimate and whether any lawsuits or customer complaints have been waged against the company.

When it comes to homeowners insurance, the people in your neighborhood could provide a wealth of information about the home insurance companies that serve your area. Ask which companies offer the most generous and all-encompassing coverage at reasonable rates. If any of your neighbors have filed claims in the past, ask if the process was quick and easy with the insurer in question.

For recommendations on other types of insurance, check with family members and people you know through work, school and community activities. With auto insurance, experiences will likely run the gamut among the people with whom you speak, but this should help you narrow down the field to the policies that would best match your needs. For information on life insurance, ask some of the older adults in your family or neighborhood.

Auto shops deal with auto insurance companies on a daily basis. As such, auto-service specialists tend to be knowledgeable about insurance deals within a given locale. Visit your trusted local auto shop for references on comprehensive insurance policies at reasonable rates.

One of the more dangerous oversights that an applicant can make during a policy signing is to leave empty lines on the paperwork. If a space is blank in full or in part, the information that you enter could be appended to your disadvantage at some later date.

Thanks to the internet, a few minutes of online searching can give you a good idea of an insurance provider’s standing with its customers. Visit consumer rating sites and financial ranking sites to help you compare insurance companies. Be sure to leave reviews on your insurance provider. This will help their business and help others to know whether they should trust them.

Insurance is meant to offer protection from sudden loss. Considering the importance of insurance for the security of your finances, you need an insurance company you can trust. At David Pope Insurance Services, LLC, we offer stable policies at low rates. We have more than two decades of experience and two convenient locations in Union and St. Clair. If you live in Missouri, Arkansas, Iowa or Kansas, we can offer you insurance to protect your assets. Contact us today to request a quote.