Have you just gotten a ticket? Many drivers wonder how tickets affect insurance rates. The myth that your car insurance rate will skyrocket if you get a ticket is widespread, but that’s not always the case.

Getting a minor ticket when you have a clean record is unlikely to significantly increase your auto insurance rate. In fact, your rate may not go up at all, especially if you purchase your coverage before getting a ticket. After you get a ticket, taking a driving course and maintaining a strong credit score can also help to keep your rate low. Ultimately, how much your rate may increase depends on the type and seriousness of your driving infraction.

When most drivers think about possible factors that could increase their rate for car insurance, speeding tickets are some of the first to come to mind. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. Whether your rate is impacted depends on how your insurance provider and state treat these violations.

Getting a single speeding ticket may not increase your insurance rate, but if you get eight points on your driving record in an 18-month period in Missouri, you will lose your driving privilege. Under Missouri state law, two or three points may be given for excessive speeding, so if you receive multiple tickets for speeding, the consequences can quickly become severe. If your rate increases, how much it jumps depends on multiple factors, such as:

Additionally, if you have a discount from your insurance provider for safe driving, you may likely lose this discount after a single speeding ticket. This could also inflate your premium.

In America, speeding is one of the most common traffic violations. Fortunately, not all speeding tickets affect insurance. If this is your first ticket, your car insurance rate may not be affected at all. In some cases, your first speeding ticket may be listed on your driving record and impact your rate, but the increase will probably be minor. Whether a first offense impacts your insurance depends on the traffic laws in your state and the degree of the violation.

After you get your first speeding ticket, you may face the following consequences:

Speeding is both expensive and deadly. Accumulating several speeding tickets in a short amount of time is when you run into trouble and risk facing considerably higher rates. Worse, your insurer may drop you as a covered driver altogether.

After you get a speeding ticket, address it as soon as possible. Ignoring the ticket could result in more serious consequences, including larger fines, points added to your license, suspension of your license and even arrest. You can respond to a speeding ticket by either paying the fine, fighting the citation in court or completing a driving course.

You can prevent a speeding ticket by slowing down, keeping an eye on your speedometer, monitoring posted speed limits, practicing defensive driving, carefully passing other drivers and watching for speed traps.

For most insurers that offer car insurance, tickets are often a matter of the violation’s severity. How far you were going over the speed limit is factored into how your insurance company treats this violation. Car insurance rates usually increase only if you were traveling at least 15 mph above the speed limit.

State laws also factor in, as many states have implemented a point system through which you receive a certain number of points for each violation on your record. How much your rate may go up depends on the state you live in, as the same violation could lead to a greater percent increase in some states than in others.

If you’ve gotten a red light camera ticket in the mail, you may wonder what it means for your car insurance rate. As with speeding tickets, whether your rate increases or not can vary. How your state treats red light camera tickets will determine whether your rate is impacted.

In some states, red light camera tickets are treated as minor moving violations, and this could lead to an increase in your premium. Other states, however, ban insurance providers from using red light camera tickets as a factor in determining car insurance rates. You can reach out to your insurer to ask whether a red light camera ticket will impact your insurance rate.

You likely won’t see an increase in your rate until it’s time to renew your policy. This is the point when insurers typically review your driving record, and after getting a speeding ticket, the price of your policy may be adjusted. The length of time a ticket could impact your insurance varies by insurer and state. In Missouri, ticket convictions remain on your record for three years after the speeding violation. Depending on the insurer, this time period will start at either the date of the incident or the date of the conviction.

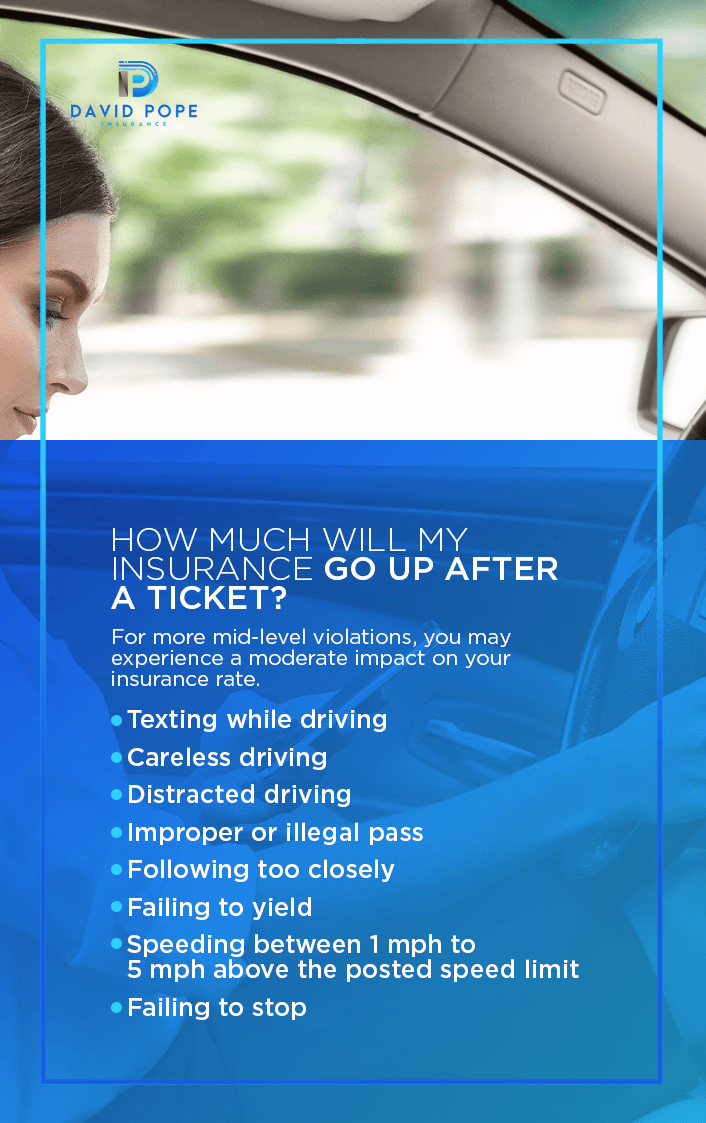

How much your insurance may go up after a ticket depends on the severity of your violation and whether this is a first offense. You can expect a much higher percent increase from these serious violations:

For more mid-level violations, you may experience a moderate impact on your insurance rate. These violations include:

For less serious violations, you can expect a lower potential percent increase comparatively. These violations include:

In Missouri, the cost of a speeding ticket can range from $85 to $474. The exact amount your premium may increase depends on your insurance company.

Moving violations refer to infractions that occur when a vehicle is in motion. When it comes to moving violations, insurance companies may increase the premium for a driver who gets a ticket. Any moving violation can affect your car insurance cost. How much your rate can be affected depends on how your insurance company and your state treat the violation.

In most states, points will be added to your license each time you disobey a traffic law. How many points are added for a violation depends on your state. Though points are not directly factored into your insurance rate by insurers, your rate is likely to be higher when you have many points on your license, as this is indicative of how many violations you have on your driving record.

Texting and driving is incredibly risky behavior. Every year, thousands are injured or killed by distracted drivers. To deter drivers from texting while driving, points may be added to licenses, and as a result, insurance companies may increase rates.

Though texting and driving is illegal in almost every state, 80% of Americans who own cell phones use them while driving. Along with texting, many read emails and talk on their phones while driving. The most frequent offenders of texting and cell phone usage when driving are drivers between the ages of 16 and 24, who also tend to be viewed as riskier drivers to insurance companies. Texting while driving impairs you manually, visually and cognitively:

Even hands-free use of a cell phone can be a significant distraction, as studies have shown that voice-activated texts also result in noticeable delays in driving response times.

Ultimately, whether a texting ticket increases your car insurance rate varies from state to state. Considering a texting ticket in an auto insurance rate is forbidden for insurance companies in some states. In other states, points are not added to your license for a texting ticket, which means your rate is not likely to go up. In Missouri, texting while driving is prohibited only for school bus drivers and drivers who are under 21. A fine for a first-time offender in Missouri varies by municipality and county and can range up to $200. Two points will also be added to your driving record.

Unlike moving violations, there is no correlation between non-moving violations and insurance rates. Because you were not operating the vehicle at the time of the violation, this will not affect your insurance cost.

Why is this? To your insurer, there is no correlation between the number of parking tickets you’ve received and your chances of filing a claim. Generally, getting into accidents means you are a liability to the insurance company, which leads to higher insurance rates. This isn’t necessarily true for drivers who get parking tickets, however. Getting a parking ticket doesn’t say anything about whether you are a good or a bad driver.

In short, the only financial consequence for you after getting a parking ticket is likely the fine associated with the infraction. If you have recently received a ticket on your parked car, rest assured that parking tickets and car insurance are not linked and your rate will not be impacted.

While traveling between states for work or vacation, you may get a ticket for a moving violation. As with getting a ticket in your state, out-of-state tickets for moving violations can impact your insurance.

Violations out-of-state are typically treated the same as moving violations in your state of residence, though whether your rate rises depends on your insurance company. The seriousness of the violation will also factor into how much your rate may increase. If you want to learn more about how out-of-state traffic tickets may impact your policy rate, speak with your insurance agent.

When it comes to your driving record, a speeding ticket can have a long-term impact. After you get a ticket, you have a couple of options for how to address it:

Paying the ticket is quite simple. You may even be able to conveniently pay the ticket online. However, keep in mind that the true, long-term cost of your speeding ticket goes beyond that initial fine. On top of this fee, your insurance rate can inflate.

You can also choose to fight the speeding ticket. In this case, you will go to court and a prosecutor will try to prove that you were indeed speeding. You may be off the hook if the officer fails to show up, but in some cases, you may not be. You should plan to make your case before the judge and anticipate questions.

After you get a speeding ticket, you don’t need to inform your insurance agent. When your policy is up for renewal, your insurer may review your driving record and determine whether to adjust your rate based on the violation.

Are you and your family looking to purchase auto insurance in Missouri? You deserve a policy that meets your unique insurance needs. At David Pope Insurance, we are a one-stop shop for residents seeking insurance in Missouri, including:

To save on your insurance, you can choose to bundle your policies. Bundling can save you a significant amount over separate policies. At David Pope Insurance, we have several years of experience in writing policies for each type of insurance coverage. We aim to find the lowest possible rates and the best coverage options for our customers. Let us know what your insurance needs are and we can find the right policy for you.

Our clients rave about their experiences with our agency. From the first call to request a quote to the policy purchase, you can expect exceptional customer service. To learn more about the car insurance coverage we offer, contact us or request a fast, free quote from today.