Your car is one of the most important assets you have. If you want total peace of mind while you’re driving your car, you might consider investing in gap insurance. We’re sure you’re familiar with comprehensive and collision insurance as a car owner. However, these insurance policies only cover what a car is worth at the time of an accident or claim.

Gap insurance (GAP), on the other hand, stands for guaranteed auto protection. This car insurance gives the car owner money back when the payment is less for a total loss than the owner’s loan or lease balance. GAP doesn’t last for your car’s entire life. You’ll only need it until your loan balance isn’t larger than the value of your car.

People typically purchase gap insurance if they don’t put any money down on their car at its purchase date and have a long payoff period. You may even owe more than your car’s value for a few years. You can also purchase GAP if you’ve leased your vehicle. There are some instances in which you won’t need gap insurance. You might not need GAP if you put down at least a 20% payment on your car when you purchased it. You also might not need GAP if you plan to pay off your car loan in less than five years.

Let’s check out a real-world example of when GAP would come in handy. Let’s say someone steals your car. Your car is worth $25,000 and your loan is $30,000. You have to pay a deductible for your comprehensive insurance to pay for the value of your car when it was stolen. In the end, you would still owe $5,500 on your loan. GAP insurance would pay that $5,500 for you. Without GAP, you’d be responsible for paying that $5,500 balance.

Another example of when gap insurance could help you out is if you purchased a $50,000 car and you put down a payment of $10,000. After three years, let’s say your car is worth $20,000 and you owe $24,000 on your loan. If you happen to get in a car accident or someone steals your car, your insurance policy would only pay $20,000 minus your deductible. Without GAP, you would be responsible for paying $4,000 out of pocket for the car. However, if you do have gap insurance, your policy would be accountable for that $4,000.

If you don’t have gap insurance, you’ll still owe $4,000, in addition to the responsibility of paying off the rest of the car even though you can’t drive it. However, if you do have gap insurance, GAP will pay the $4,000 for you. In summary, if you have a car loan, gap insurance is like a supplemental insurance policy. GAP will pay the rest if you get in a wreck and your auto insurance policy pays out less than you owe the lender.

If you’re interested in getting GAP for your vehicle, there are several ways to secure this insurance and stay protected. You can purchase gap insurance from:

If you fit the criteria to purchase GAP, you can ask your auto insurance company to add it to the policy you already have. You can also look at different prices online to ensure your insurance company offers you the best deal possible. Before you purchase gap insurance, make sure that you don’t already have it for your vehicle. Some lease deals have GAP pre-built into them for your convenience.

You can also often get GAP from the dealership where you got your car. However, gap insurance from a dealer or lender may come at a higher rate than what your auto insurance company offers you. Do your research ahead of time to determine where you’ll get the best GAP price.

If you want to buy GAP from your insurer but you’ve already bought it from your car dealer, the dealership may allow you to remove it from your contract. Just make sure you have overlapping coverage during the period when you’re switching providers to ensure you’re properly insured at all times.

If you have a car loan or a lease, you can add gap insurance to your policy. Some insurers have requirements you must meet to qualify for GAP, such as that your car is no more than two or three years old. Insurance companies also might require that you’re the original owner of your car. When you contact your insurance company, they’ll be able to tell you what your options are concerning GAP and how much it’ll cost you. You likely won’t need GAP for the entire lifespan of your car.

Suppose you’re worried about being unable to make up the difference between your comprehensive and collision insurance cover for an accident. In that case, it’s a good idea to get GAP even after buying your car. You may even find a situation or policy where your GAP covers your other auto insurance deductibles. Most lenders will require you to have comprehensive and collision insurance for the entirety of your lease or loan before you purchase GAP, so make sure you have those before pursuing gap insurance options.

Keep in mind that your car will decrease in value as soon as your drive it off the lot. Within a year, your car could lose 20% of its value, and your auto insurance company will only cover the car’s value at the time of an accident or claim. You can calculate your car’s expected depreciation with online tools, such as the Car Depreciation Calculator.

This unavoidable loss in value is part of why GAP is so helpful. For example, when you put down a small deposit at the financing of a new car, the amount of your loan might be higher than the market value of your car for the first few years. Gap insurance helps you cover the difference.

There’s no law that says you have to purchase GAP. However, certain lenders and lessors might require you to buy gap insurance. Depending on your situation, GAP may be an excellent investment for you.

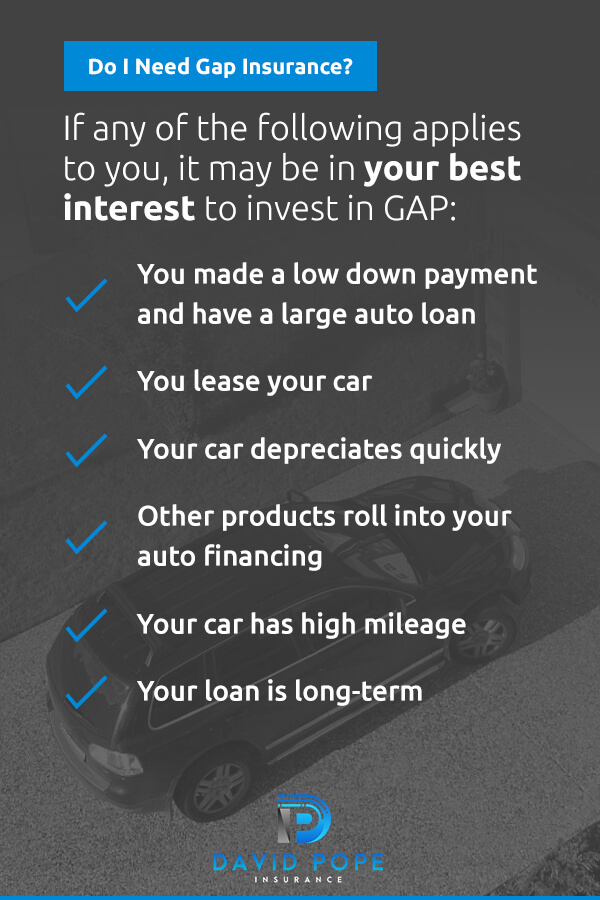

It may be prudent for you to invest in GAP for your new truck or car if the following criteria apply to you:

If any of those qualities apply to you or you relate to such scenarios, it may be in your best interest to invest in GAP. Gap insurance could help you financially in a situation when your car is declared a total loss. Just make sure you cancel your GAP once you owe less than the book value of your car. Your insurer may not drop it for you automatically, so make sure you do so yourself.

If you’re interested in learning more about situations in which gap insurance will benefit your car, check out these scenarios. If any of the following applies to you, it may be in your best interest to invest in GAP:

You may be able to get away without purchasing GAP insurance if you relate to the following:

It may be a good idea to check what your car is worth before purchasing gap insurance. You can check the National Automobile Dealers Association (NADA) guide or Kelley Blue Book to find out what your car is worth at various times. Compare the value of your car to your loan balance. If your car’s value is higher than your loan balance, you no longer have a gap to worry about.

Auto insurance companies generally charge about $20 a year or a couple dollars a month for gap insurance. However, the cost of GAP for your car will vary based on different factors, such as your car’s value. Don’t forget to purchase collision and comprehensive coverage along with GAP.

You can purchase GAP from a lender for a flat fee. These flat fees can range between $500 to $700. Keep in mind that credit unions may charge less.

If you add GAP to your loan, you’ll have to pay interest on it at an average rate of 6%. Considering this average rate, you could end up paying more than $800 for three years of coverage from a car dealer rather than $60 from your auto insurance company. Keep in mind that interest rates will vary depending on the car dealer or auto insurance company.

Purchasing GAP from an auto insurance company is usually your most cost-effective option. An auto insurance company will typically charge you 5% to 6% of what you pay for your collision and comprehensive coverage. That being said, you would likely only have to pay $50 to $60 extra for GAP.

The cost of GAP will vary depending on the following factors:

When you invest in gap insurance, you’ll experience the following benefits and more:

At David Pope Insurance Services, LLC, we’re committed to getting you the lowest rate for gap insurance on the market.

Why work with us? We have a flexible schedule to answer your questions or provide quotes on the same day they roll in. Even if you submit a request for a quote via email or Facebook, we’ll get back to you immediately. Check out the following benefits of working with us:

We offer the following services:

Want more information about auto insurance? Take a look at the resources we’ve collected for you on our website.

If you want to know more about us, check out the testimonials on our website or get in touch with us at 636-535-1055 today!