State and federal laws require every vehicle owner and driver to take financial responsibility by having car insurance. There are different minimum coverage requirements, depending on where you live. While no one hopes to get in an accident, it’s crucial to prepare for the possibility.

You must understand what specific insurance policy you need and what liability and premiums best suit your situation. Car insurance is essential because it offsets the possible financial burdens arising from auto accidents, helping with damage to your and other vehicles, bodily injury, medical bills and property. Unlicensed drivers may still need car insurance, and car owners who no longer drive might also need coverage.

Navigating insurance for unique situations is our specialty. Our expert agents know exactly how to find a policy that fits your specific needs.

Explore Your OptionsThe short answer is yes, an unlicensed driver can get car insurance if they own a vehicle. Still, there will be situations where you need a license to get insurance depending on the insurers you deal with. Certain laws and guidelines regarding car insurance require you to have insurance for your automobile despite the status of your license. Other times, some insurance companies may have issues providing you with car insurance as an unlicensed owner. Companies want your driver’s license number to easily access your driving record and history.

They often look at the last three to five years to check for any traffic violations or accidents you may have been in. Without a valid license number, they may have issues reviewing your driving history, making you a risk in their eyes.

While you have many insurance agencies to consider, major chain companies may almost instantly turn you away without a license. Other companies may have modified policies or policies that are much more expensive. Though smaller insurance companies may be open to insuring you without a license, their rates and coverage may be less appealing.

Because looking for no-license car insurance may be more challenging than it would be for someone with a driver’s license, your best option may be to search for insurance through a broker. They can look through available options to find carriers who offer car insurance to the unlicensed. Since they better understand the industry, an insurance broker can find an insurance company and policy that is most suitable for you and your needs.

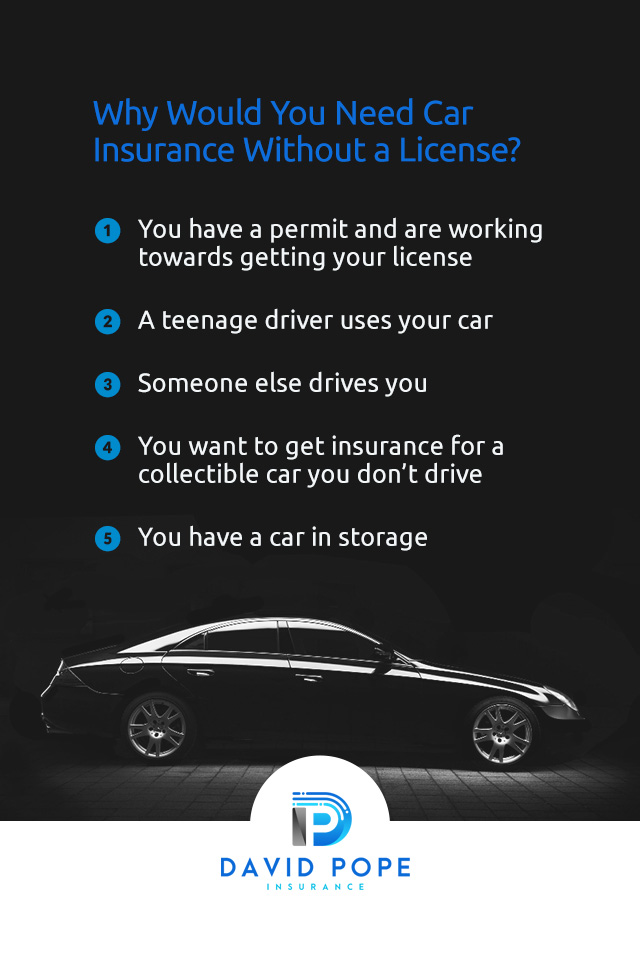

If you are a non-driver vehicle owner, you should still get a no-license auto insurance policy in various situations. Speaking with someone who understands your circumstances can help you receive the options you need to keep your vehicle safe and navigate the application process. Here are a few situations where you may need to insure a car without a license.

Usually, auto insurance for unlicensed drivers means the driver has a learner’s permit. If you are a student driver, you lack an official license and are working toward getting it by logging driving hours. You will need insurance before you get on the road in case of an accident.

If you are the titleholder of a car and you have a teenager who will drive it, you must get it insured. Some states prevent anyone under 18 years old from entering a contract, so their parent or guardian may need to do so. Even if you lack a license, you must insure your car so your teenage driver can take it out on the road.

Similar to the previous scenario, if someone with a driver’s license plans to drive your car, you need to have it insured — even if you cannot drive or choose not to. Whether this person is a personal driver, chauffeur or a family member you rely on for transportation, you need insurance that will cover them in an accident.

You still need to insure your vintage, classic or collectible car, even if you do not drive it. As with any expensive assets, valuables or collections, you want to avoid full or partial loss of your investment if something damages or ruins it. Some insurance companies offer classic car insurance, which covers the cost of replacing or repairing specialized parts.

In this instance, your car must meet specific requirements to qualify for classic car coverage.

Even if your car is not classic or collectible, you should still have it insured to minimize monetary loss due to damages incurred during storage. Parked-car or stored-car insurance will often cover damages resulting from:

In this situation, consider getting a comprehensive coverage policy, which covers non-collision repairs to your car. You can usually get this car insurance without needing to provide a driver’s license, since your vehicle will remain in storage. This policy also costs less than other insurance policies with liability coverage. Still, your vehicle will be uninsured while driving with insurance that only covers the car when it is in storage or parked.

You may still apply for car insurance with a suspended driver’s license. However, looking for insurance coverage while having a revoked or suspended license might mean you’ll pay a higher rate than if you were looking for car insurance with an active, valid driver’s license. Despite the higher costs, it may be just as necessary to have insurance without your license as it is when you are an active driver.

In some states, you may need car insurance to reinstate a suspended or revoked license. For example, suppose you want to regain your driving privileges after having your license suspended or revoked from an uninsured accident or another traffic-related offense. In that case, insurance companies may require you to have SR-22 coverage.

SR-22s are forms or certificates your insurance provider fills out to prove to the state that you have adequate coverage, since they may now consider you to be a high-risk driver. Most companies that sell car insurance can help you get your SR-22 forms.

The insurance company will electronically file your form with the state to prove you have the proper coverage and financial liability, essentially making it legal for you to drive. Depending on the company, they may do this for you for free, while others do it for a fee.

When you get insurance on a vehicle, insurance companies assign the primary driver’s title to the car’s main user. The primary driver is who drives the car the most, not necessarily the owner. They list anyone else in the home who regularly uses the car as a secondary driver.

Insurance companies factor in the primary driver’s driving record and everyone else listed on the policy to calculate the amount you must pay to have your car insured. Insurance companies consider everyone in your home with a driver’s license in your premium. Still, you may want to omit specific household members from your policy. In that case, you must make them a named excluded driver to prevent them from driving your car and receiving coverage for any damage they might cause.

There are a few reasons you might exclude someone from your policy — primarily, to lower your premium. Some other cases may include the following.

If you have a driver’s license and do not have a car, you can still obtain liability insurance. Non-owned car insurance gives coverage to non-vehicle owners who drive someone else’s by either borrowing or renting them.

A non-owned car insurance policy provides the driver with liability coverage, which pays for property damage or injury. This type of policy excludes collision or comprehensive insurance, so the policy negates paying for the cost of any damage to the vehicle driven by the policyholder and covering non-accident damage. The vehicle owner is responsible for protection against physical damage to the car.

Another aspect of a non-owner policy to consider is if you are between vehicles. If you sell the car you own with plans to purchase a new one, it may benefit you to have a non-owner policy in the period between cars. Because insurance companies see a gap in coverage as a sign of you being a high-risk driver, this can increase your rates. Keeping a policy while between cars can help you keep your insurance premium at a lower price.

Non-owner car insurance policies are generally less expensive than the same amount of liability under a traditional plan. Factors that may affect your rates will include:

The easiest way to get your car insured without having a driver’s license is by listing someone else on the policy as the primary driver. Whether it be a spouse or child, caretaker or roommate, listing someone else as the primary driver informs the insurance company that you will not be the vehicle’s main driver.

Along with removing yourself from the primary driver position, you can also ask your insurance agent to list you as an excluded driver, meaning you are not a user at all.

Another way to get automobile insurance without a license is to opt for a parked car insurance policy. This type of comprehensive policy protects your parked car from damages from vandalism, fires, floods or falling objects.

Start your search for car insurance without a license by looking for available carriers that accept unlicensed car owners. Though looking at insurance companies online can be useful under average circumstances, most sites require a driver’s license number for you to get a policy quote.

Before you find yourself having trouble or completely unable to get insurance coverage, consider going through a reputable independent insurance broker. Working with someone who understands the business and can help you figure out what coverage will benefit you the most can help you use your time and money wisely.

You know the process, now let us handle the paperwork. We’ll work with our network of carriers to get your car insured quickly and correctly.

Get My Car Insured Today

At David Pope Insurance Services, LLC, a family-owned insurance agency local to Union, Missouri, we take pride in generating fast and flexible quotes for our customers. Whether you need to find coverage in Tennessee, Illinois, Nebraska, Colorado, Arkansas, Iowa or Kansas, we are here to help.

We welcome you to contact us through our website or at 636-583-0800 with any questions or concerns. If you are looking for a quote, request one here to get started today!

If you need to find the right coverage for your specific needs, we can help connect you with the right policy type and coverage for your vehicle or vehicles, regardless of your driver’s license status.

No matter your circumstances, we’re here to find a solution. Partner with an independent agent who has the flexibility to find the right policy for you.

Talk to an Insurance SpecialistWas this post helpful for you? As a family-owned insurance agency, we understand the significance of having the most effective car insurance. That’s why we have a wide selection of auto insurance guides to assist you with any other queries you may have. From receiving the cheapest car insurance rates to steps you should take after a car accident, we provide various resources to ensure our readers have the most valuable information to ease their situations.